Revolutionize Your Business with GST Solution

One-stop solution that lets you stop worrying about GST complexities, speed up the GST return process, stay updated and compliant with GST regime, reconciliation, returns and reports.

Monitoring of Transactions (Sales/Purchase)

Easy Data Backup

Series Selection (All/Few)

Change Financial Year

Easy Switch B/W Past & Present FY

Smart, In-built GST Solutions India's Best GST Invoicing and Returns Filing Software

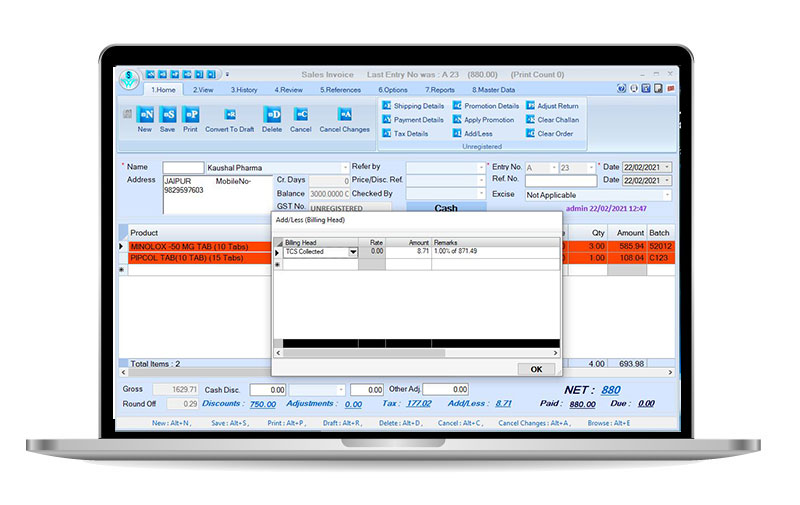

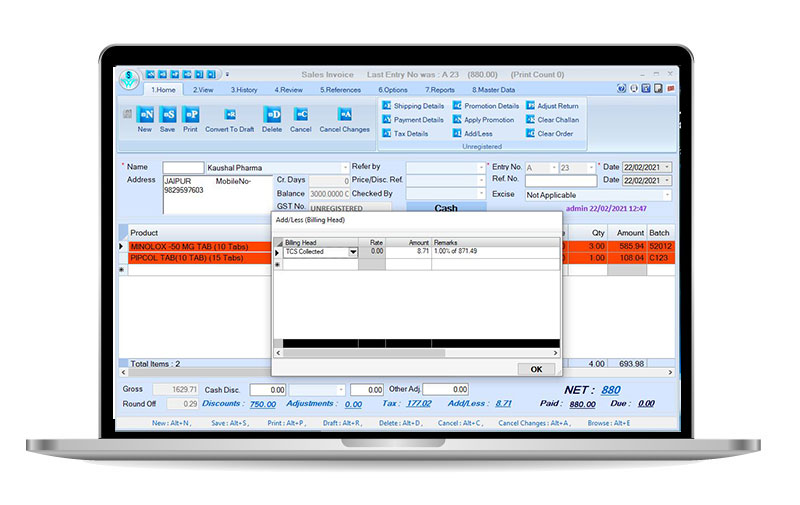

TCS (Tax Collected at Source) Creation

- Business based TCS provision

- Simplify TCS Payments & Returns

- Help in Tax Collection at Source (TCS) under GST

- Make you able to comply with law

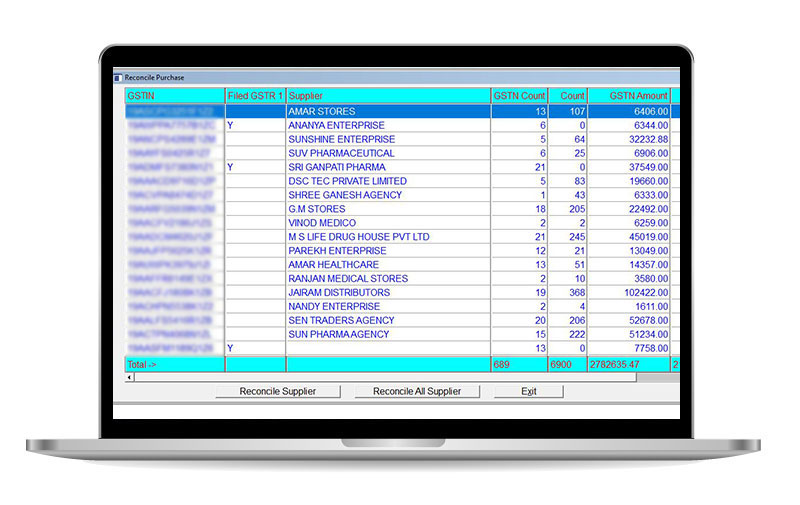

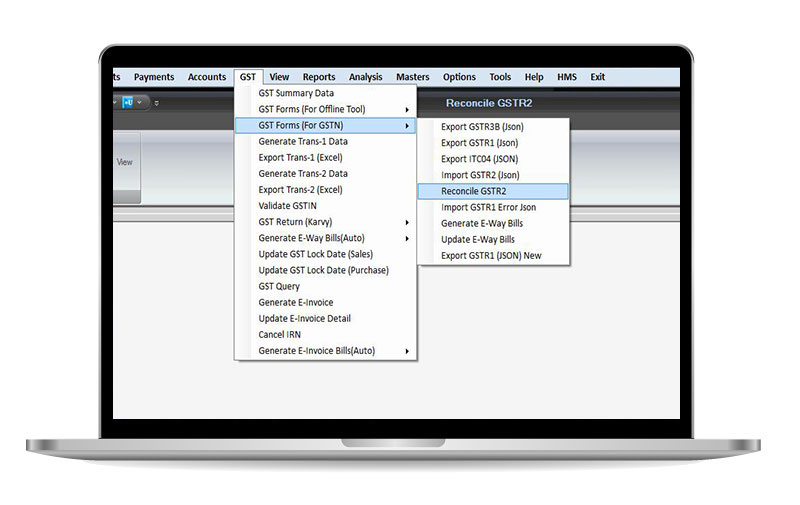

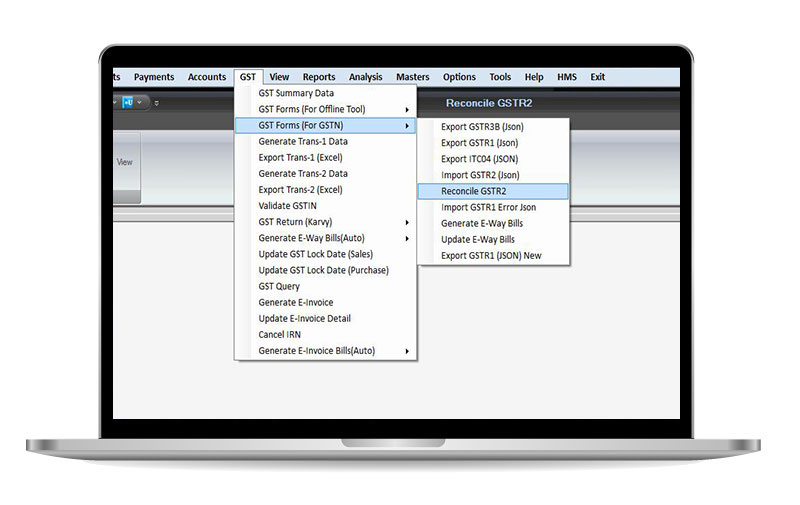

GSTR 2A Reconciliation

- Easy view on tax details for purchases

- Details get Auto-populated on GST Portal

- Purchase bill download facility

- Reconcile GSTR 2A without logging into the GST portal

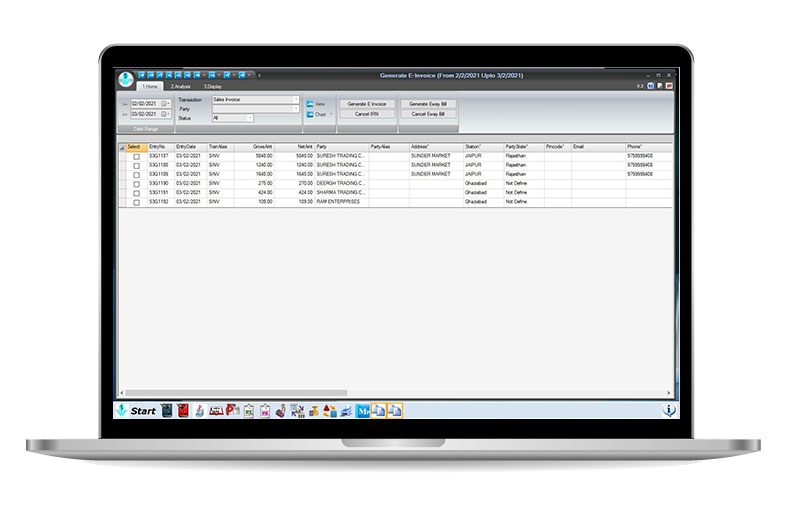

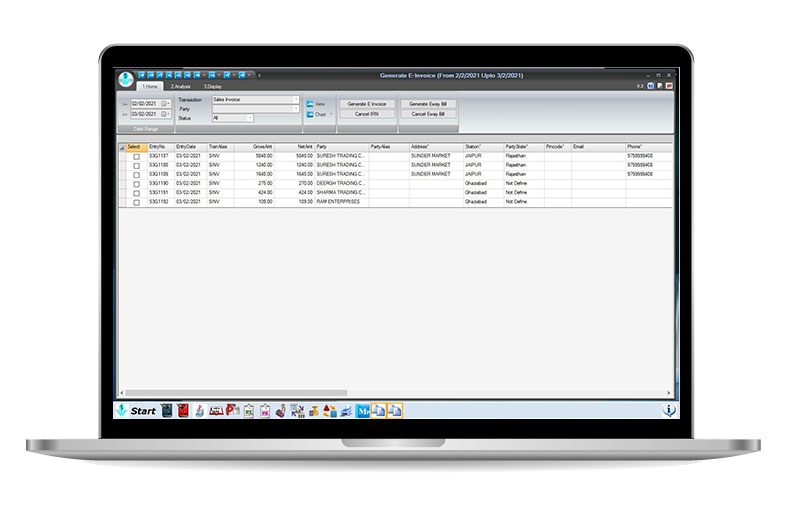

GST E-invoicing

- Auto E-Invoicing Generation and Submission by Third Party Integration

- Generate GST compliant invoices

- Manual E-invoicing Generation and Submission by JSON

- E-invoice Updation

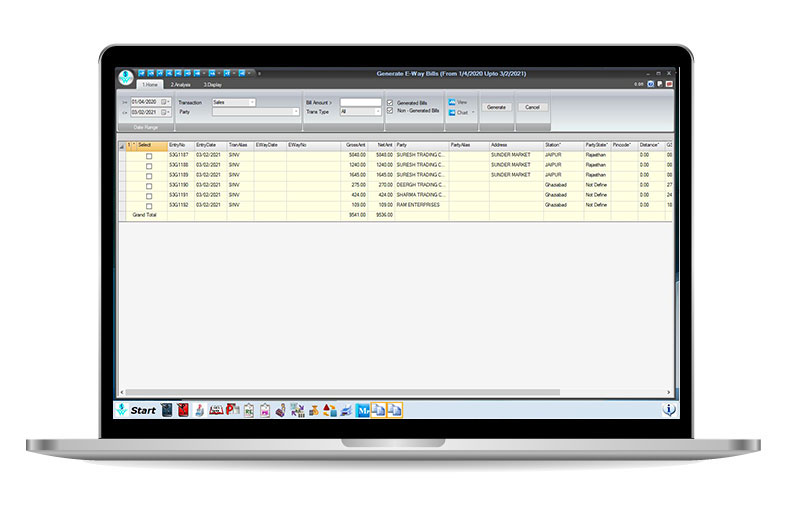

GST E-way bill

- Auto E-Way Bill Generation and validation by Third Party Integration

- Correction is available in E-Way Bill

- Auto E-Way Bill Submission at Govt. GST Portal

- Manual E-Way Bill Generation and Submission by JSON

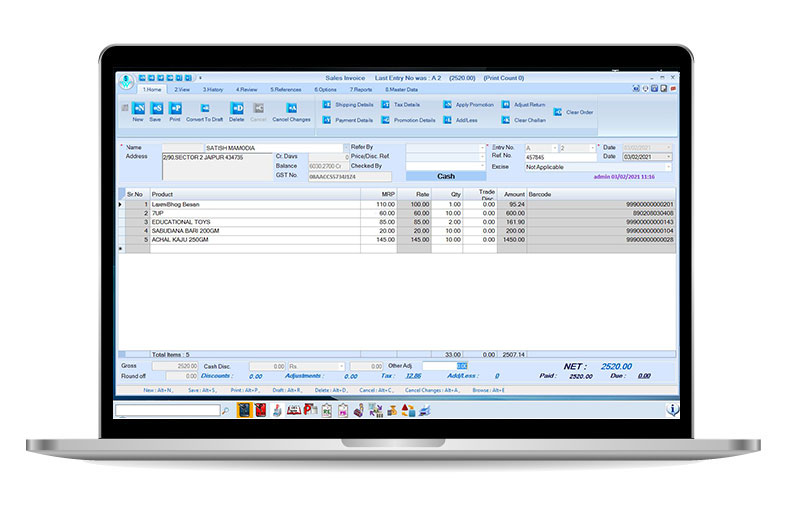

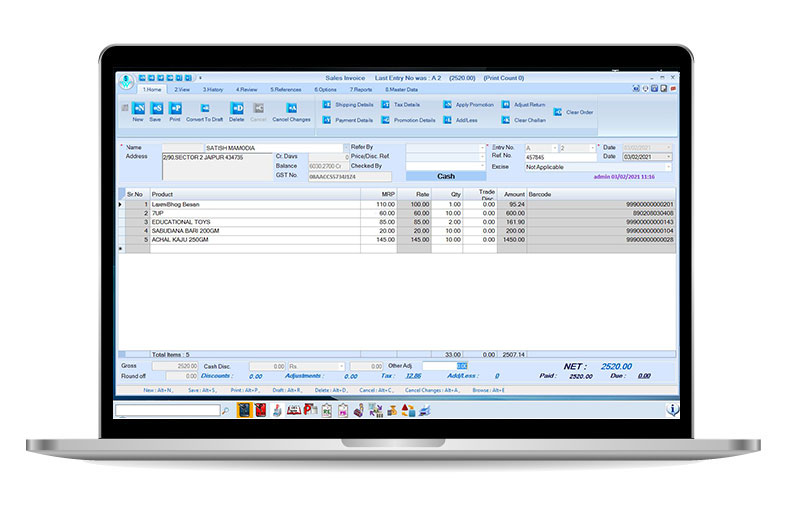

Invoicing (Sale & Purchase) for Goods & Services

- Provide Industry-specific Billing Format

- Billing for Goods and Services

- Purchase Invoice for Unregistered Dealers

- Tax Invoice for Sales & Purchase Returns

GST Invoicing Reconciliation

- Help invoice reconciliation

- GST Return Facility

- 100% error-free returns via verification tool

- Cost-effective in nature

GST Reports & Import/Upload

- Generate GSTR 1, GSTR2, GSTR 3B, ITC04, GSTR9

- Generate Report in JSON & CSV Format

- Export Excel/CSV file for GST offline tools

- Upload JSON File directly on Govt. Portal

- Multi Branch handling in GST Reports

- Option to Print HSN Code in Reports

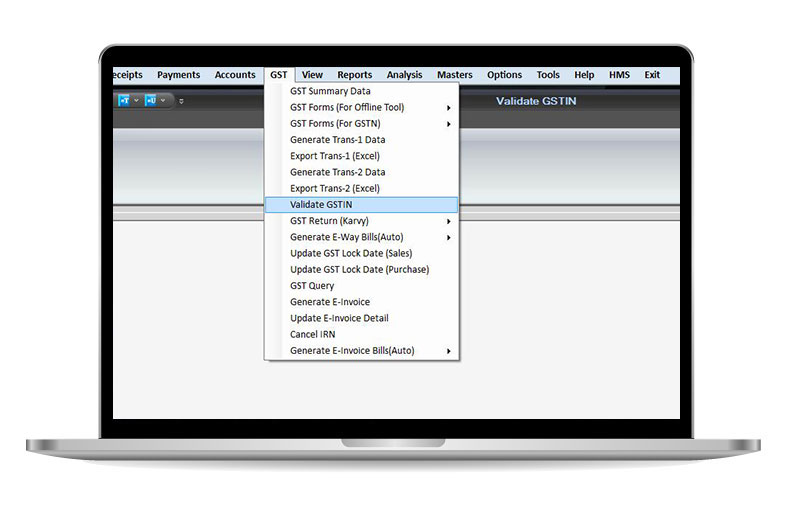

GSTIN Validation

GST Validation is used to validate the authenticity of the GSTIN number. It helps to find out fake GSTINs on the GST portal.

GST Query

GST query is used to view various business reports and HSN summaries. Business owners use these reports and HSN summaries to gain deeper insights into setting different business objectives.

GST Summary Data

GST Summary Data gives the business a cross-verification capability. It verifies all the available GST reports and doubly ensures that you have an error-free business.

One-Stop Solution for GST Billing

One place to track all your business data with advanced billing transitions that suit your business needs.

GST Invoicing Reconciliation

Match supplier's invoices with recipient's details in GSTR-2A

Stops incorrect ITC claims

Avoid GST returns filing penalties

Data Validation Facility

Validate data before uploading to GST portal

Ensure compliant data with the GST laws

Offer summary of uploaded data

Search & Update details of Taxpayer

Ensure data accuracy

Reducing the risk of errors

Avoid mismatches in GST returns

Invoicing (Sales & Purchase) For Goods & Services

Accurate and error-free invoicing

Enable faster payment receive

Manage sales/purchase invoices in one place

GST Lock Data

Save data from unauthorized access

Ensure accurate GST returns

Offer audit trail to identify discrepancies

HSN Categorization

Easy classification of goods

Accurate tax calculation

Compliance with regulations

TAX Category

Assigning tax categories to goods and services

Enabling quick invoice & return generation

Process transactions faster

IRN Generation

Facilitate invoice tracking

Unique IRN for each invoice

Easy e-way bills generation

Print E-invoice

Enhanced record-keeping

Smart financial management

Reduces errors and fraud

Import Error Check

Real-time error identification

Makes record up-to-date

Reduced risk of penalties

Cancellation of E-invoice

Improved customer service

Compliance with GST regulations

Instant solution for errors & frauds

Get Existing E-invoice Records from Portal

Easily get previously generated e-invoices

Proffers informed business decisions

Reduces the risk of errors

Manage Multiple GSTR Files Efficiently

Export GSTR 1

Easy file of monthly/quarterly return, summarizes all sales, available in all file format (Excel, CSV, JSON)

Export GSTR 9

Assists you in filing annual return, consists inward/outward supplies, taxes paid, refund claimed & more

Export GSTR 2

Automate monthly GST file, monthly purchase details, invoice details of all supplies, help reduce input tax credit

Export GSTR 3B

Gives simplified return summary of sales, ITC claimed, and net tax payable in Excel/JSON, must for every GSTIN

Export ITC01

Offer easy claim of input tax credit, ensure accuracy in filing declaration form GST ITC-01

Export ITC03

Smooth return file for taxpayers who opt for composition scheme or when taxpayer-supplied products, services, or both are completely exempt

Export ITC04

Get details of inputs or capital goods dispatched or received from a job worker in a quarter in Excel, JSON format

Available Multiple GST reports that ensure accurate and smooth filing

GST Summary Data

GST Summary Data gives the business a cross-verification capability. It verifies all the available GST reports and doubly ensures that you have an error-free business.

GST Query

GST Query is used to view various business reports and HSN summaries. You can use these reports and HSN summaries to gain deeper insights into setting different business objectives.

Tax Audit Report

Option offers easy transfer data into excel, easily tally report with the GST query details. The report ensures accounts are correctly prepared and the taxable income is accurately calculated as per Income Tax Act.

Simplify Your GST Data Export/Import with Multiple Data Export Formats

(Improved analysis, Improved record-keeping, Time savings, Enhanced decision-making, Compliance with GST regulations)

Data Export

Allows businesses to export data in various formats such as Excel, CSV, or JSON.

JSON Validation Check

Allows quick validation of the JSON before submitting them to the GSTN portal.

Import from Government Excel

Reduces the risk of errors to import data from Excel files provided by the government.

GST Billing Software with Time-Saving Integrated Solutions

e-Invoicing

Auto E-Invoicing Generation and Submission by Third Party Integration

Generate GST-compliant invoices

Manual E-invoicing Generation and Submission by JSON

E-invoice Updation

Applicable for businesses with a turnover exceeding 10 crores

Generated when there is a movement of goods in a vehicle

Conveyance of value more than Rs. 50,000

Auto E-Way Bill Generation and validation by Third-Party Integration

Correction is available in E-Way Bill

Auto E-Way Bill Submission at Govt. GST Portal

Manual E-Way Bill Generation and Submission by JSON

Benefits of Using SWIL Solutions

SWIL offers several curated benefits that help you scale up and grow your business faster and easier.

Easy Taxpayer Search

Retrieval of taxpayer information

Promote transparency in business transactions

Verification of GSTIN

Quick Update of GSTIN details

Ensures accurate/up-to-date GSTIN details

Reduces the risk of errors/penalties

Improve compliance with GST regulations

Auto-populate GST for transactions

Saves time by automatically filling GST details

Correct GST rates are applied

Automate E-invoicing and E-way Bill generation

Label your items to stay compliant

Label items with applicable GST rates

Simplify tax calculation

Ensure that the correct GST rates are used

Create GST-compliant invoices

Generate invoices complying with GST

File error-free GST returns with approval

Apply correct GST rates to each invoice

Easy switch to e-invoicing for better security

Switch from paper-based invoicing to electronic invoicing

Auto calculation of correct GST amounts

Enhanced security, cost savings, improved efficiency

Effortless e-way bill generation

One click e-invoice generation from E-way bill

Create e-way bills, Debit/Credit Notes, Delivery Challans

Eliminate need for manual data entry

Generate your returns report with ease

Offer GST reports with minimal effort

Quickly know sales, purchases, and tax liabilities

Improve accuracy in GST return filing

Collect payments 3x faster

Share bill instantly via WhatsApp or Email

Collect payment through multiple modes

Track their payment status

GST Billing Software Suited for All Indian SMEs

RETAILER

WHOLESALER

DISTRIBUTORS

FRANCHISES

PRICING PLANS OF GST BILLING SOFTWARE

SwilERP is a fully integrated software for retail, distribution and chain store that comes with advanced features to manage the entire business process, including multi-users, locations etc.

CHECK PRICING PLANSSwilERP Web is an online cloud-based solution for Retail, Distribution, Chain store and franchises. It gives freedom to work from anywhere, anytime and any place.

CONTACT SALESFrequently Asked Questions (FAQs) Get answers to some common questions about SwilERP GST billing Software here:

What’s New in GST Billing Software

#SWILFamily

35000+ Satisfied Users

600+ Nationwide Partners

500+ Senior & Experts Team

4.5/5.0

Say, Hello

Boost Your Business Sale with SWIL Software

.png)