Aadhaar, India’s national identification number, can now be linked with the pan card. This will allow people to access various government services, such as education and health care.

Aadhaar is an important identification number issued to residents of India by the Unique Identification Authority of India. It is also known as a PAN card. The unique identifier helps in verifying the identity of a person and tracking all financial transactions that he or she makes. In addition, it is also used to establish proof of residence, education, employment, etc. Linking Aadhaar with the PAN card is mandatory for all citizens who want to avail government benefits and services.

Aadhaar linking with a PAN card is important for several reasons. Firstly, it will help curb tax evasion. By linking Aadhaar with PAN, the government can track all transactions that involve money and ensure that taxes are paid on time. Secondly, by linking Aadhaar with PAN, the government can also track criminal activities and prevent crime. Thirdly, by tracking all transactions, the government can also improve economic efficiency.

Article Content-

- Why do you need to Link your Aadhar with your PAN Card?

- What are the benefits of linking an Aadhaar with a PAN card?

- Process of linking Aadhaar with PAN card

- What Factors Must Be Taken Into Account When Linking an Aadhar Card to a PAN Card?

- How to Link Aadhar with PAN via SMS?

- Discuss the possible challenges in linking Aadhaar with a PAN card

- FAQs

- Conclusion

Why do you need to Link your Aadhar with your PAN Card?

The PAN card and Aadhaar linking date have been extended by the Income Tax department until 1 April 2020. The deadline has already been extended eight times. Since the Supreme Court’s ruling on Aadhaar was made public in 2018, you must have this 12-digit identification number to file your income tax returns and apply for a Permanent Account Number (PAN) card.

All taxpayers must now link their Aadhar with their PAN cards in order for the income tax department to process their further income.

If this isn’t done by April 1, 2021, your PAN will become inactive, meaning you won’t be able to use it for any financial transactions where it’s required (like opening a bank account).

One will not be able to file an ITR after April 1, 2021, without connecting the first two.

What are the benefits of linking an Aadhaar with a PAN card?

Aadhaar is a 12-digit unique identification number issued to all Indian citizens. It is mandatory for all residents of India to link their Aadhaar with their PAN card. The purpose of linking the two cards is to ensure that tax payments are made accurately and efficiently.

The benefits of linking an Aadhaar with a PAN card include:

1. Increased accuracy in tax payments

By linking an Aadhaar with a PAN, taxpayers can ensure that their taxes are paid accurately and quickly. This increased accuracy can save taxpayers time and money, as they will no longer have to wait for refunds or dispute erroneous deductions made by the government.

2. Reduced tax fraud

By linking an Aadhaar with a PAN, tax fraudsters will have difficulty evading taxes as their identities and financial information will be easily traceable. Additionally, by linking an Aadhaar with a PAN, the government can better target tax relief and assistance to those who truly need it.

3. Reduced identity theft

By linking an Aadhaar with a PAN, identity thieves will have a harder time stealing someone’s identity and using that information to commit crimes. By linking an Aadhaar, the government can also better protect the personal information of Indian citizens.

4. Increased efficiency and transparency in government services

Aadhaar will help ensure that government services are more efficient and transparent, as all relevant information will be easily accessible. This will help to improve the quality of government services and ensure that taxpayers are getting their money’s worth.

Process of linking Aadhaar with PAN card

Your Aadhar can be connected to your PAN in one of two ways:

The first method involves logging your e-filling account in four steps.

Reminder: If you haven’t signed up for the e-filling portal yet, do so first.

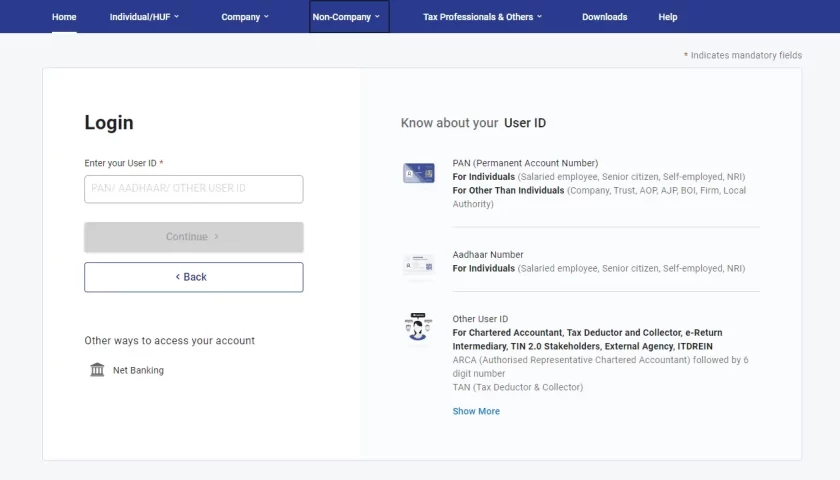

Step: 1 Firstly Enter the login information to access the Income Tax e-filing portal (ID, password, and date of birth).

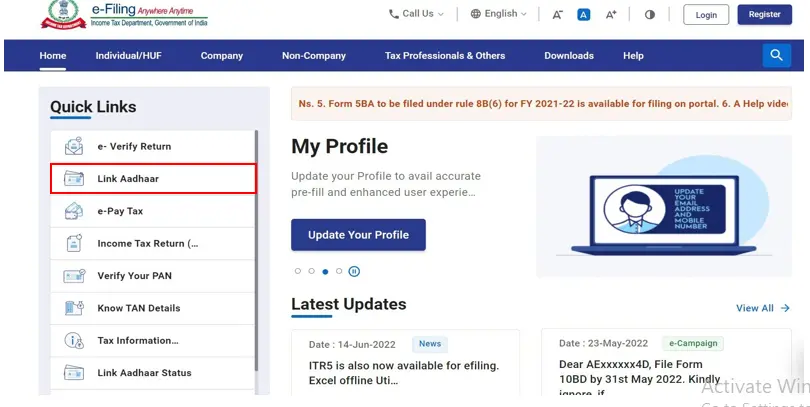

Step: 2 You must select “Link Aadhar” on the “Profile” page after logging in.

Step: 3 Now, in the “Link Aadhar” window, you must include the following information as it appears on the Aadhar Card, birthdate as it appears on the PAN card, and gender (The server will automatically update it.), state your Aadhar Number now. Finally, enter the Captcha code, then press the “Link Now” button.

Step: 4 You will now see a pop-up stating that your Aadhar and PAN have been successfully linked.

Method 2: Not logging your air conditioning (2 steps involved)

Step 1: Visit www.incometaxindiaefiling.gov.in and select the “Link Aadhar” option from the menu on the left.

Step 2: You must now provide the following information in the “Link Aadhar” field;

- Please now state your PAN number.

- Specify your Aadhar number.

- Give your name as it appears on your Aadhar card.

- Place a checkmark next to the choice if your date of birth on your Aadhar card falls solely in the month of March 2020; otherwise, leave the option as-is.

- Mention the Captcha code once more, then press the “Link Now” button.

- You will now receive a confirmation from the UIDAI following verification.

What Factors Must Be Taken Into Account When Linking an Aadhar Card to a PAN Card?

When fusing Pan Card with Aadhar, the following factors must be taken into account:

- The applicant’s name should be identical on both forms (Aadhar & PAN), albeit small modifications can still be accepted.

- You must have access to the mobile phone number associated with your Aadhar card.

- The date of birth should match and be in the proper format (DD/MM/YYYY) on both the Aadhar and PAN documents.

- No gender-related discrepancy will be investigated further.

How to Link Aadhar with PAN via SMS?

To link your Aadhar with your PAN exclusively via SMS, simply follow the instructions provided by the Income Tax Department:

First, send an SMS in the following format from your registered cell phone to 567678 or 56161:

UIDPAN = 10 digits PAN + 12 digits Aadhaar + SPACE

UIDPAN 123456789123 AKPLM2124M, for instance.

After that, UIDAI will text you to confirm when it has been completed successfully.

Discuss the possible challenges in linking Aadhaar with a PAN card

There are a few possible challenges in linking Aadhaar with a PAN card. For example, if the individual does not have an Aadhaar number, they may be unable to get a PAN card. Additionally, if the individual’s Aadhaar number is invalid or missing, they may not be able to link their PAN card with their Aadhaar number.

Finally, some individuals may find it difficult to remember their UIDAI authentication code or password. If any of these challenges prevent an individual from linking their Aadhaar and PAN cards, they may need to contact either the government agency responsible for issuing both cards or UIDAI for assistance in resolving the issue.

FAQs

1. Can we link Aadhar to PAN on mobile?

Currently, Aadhar can be linked with PAN only through a computer or by visiting an Aadhaar enrolment center. With this new directive, users will be able to link their Aadhar and PAN on their mobile phones as well. This will help them carry out various financial transactions and access government services more easily.

2. How long does it take to link Aadhaar to a PAN card?

To link Aadhaar with a PAN card, residents must visit a designated location or go through the online process. The process typically takes around 15 minutes to complete.

3. How can I check my PAN card details?

The answer is quite simple – by visiting the website of the Indian government department responsible for managing the PAN card database. On this website, you can enter your full name and unique identification number (PIN) to view all of your account information, including transactions and balances. You can also update your personal details or dispute any errors on your PAN card.

4. Is it mandatory to link Aadhaar with PAN for minors?

In India, it is mandatory to link Aadhaar with PAN for all individuals who are below the age of 18 years. This includes minors who are below the age of 15 years. Some people argue that it is not necessary to link Aadhaar with PAN for minors because they do not have any income or property. Others believe that linking Aadhaar with PAN will help prevent tax fraud and identity theft.

5. How can link Aadhaar with a PAN number by SMS?

In order to link your Aadhaar number with your PAN number, you can do so by texting the two numbers to each other. The process is simple and can be done without leaving your computer. Here’s how it works: First, open the Aadhaar website on your computer. On the homepage, click on “Aadhaar linking”. You’ll be taken to a page where you will have to enter your Aadhaar number and password. Next, you’ll have to enter your PAN number. After completing these steps, you’ll be asked to confirm the linkage. Click on “Confirm Linkage”. If everything goes well, you’ll be redirected to a page showing the success of the linkage.

6. Difference between an Aadhaar card and a PAN card?

The two different cards are Aadhaar and PAN. An Aadhar card is a unique identification number issued to residents of India. It is similar to a social security number in the United States. A PAN card, on the other hand, is a document that is used to track taxable income.

Conclusion

The process to link Aadhaar with Pan Card is straightforward. First, you will need to visit the nearest Indian embassy or consulate to get a PAN card.

Once you have obtained your PAN card, you will need to visit the website of the Unique Identification Authority of India (UIDAI) and enter your Aadhaar number. You will then be prompted to provide your date of birth and other personal information.