The standardization of invoice reporting in India is a component of e-invoicing. By making the GST return process simpler, e-invoicing provides taxpayers with convenience.

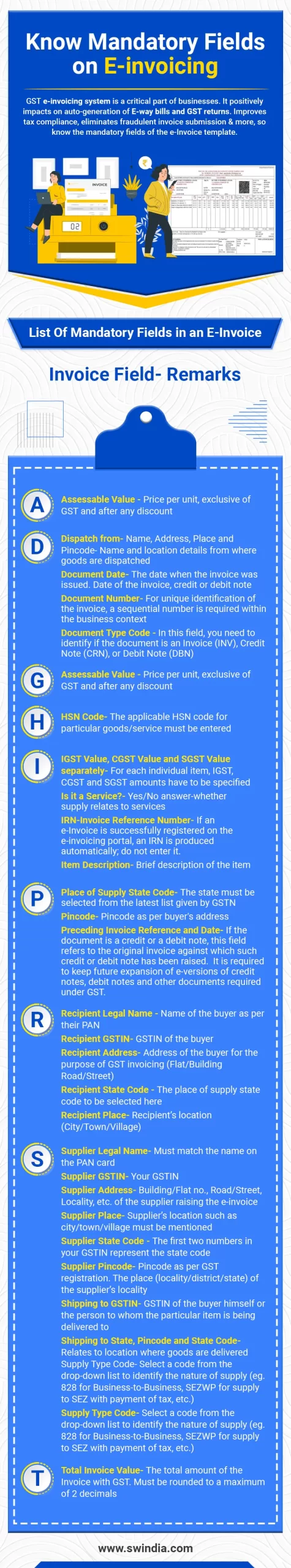

While filling out any official or non-official document, you must keep complete information about it, which does not have any scope for mistakes. What are the fields in it, how are they related to the business, why are they important, how are they obtained, etc.

Any retail or wholesale business must now update its operations by using advanced accounting and reporting systems for GST return filing and E-invoice generation.

The infographic below is in the context of filling the e-invoices. It shows all the mandatory fields that are required for e-invoicing.

A proper e-invoicing submission can give-

- Better account reconciliation

- Reduced operational costs

- Fewer disputes and rejected invoices

- Improved customer satisfaction

- Reduce the number of fraudulent invoices submission

- Reduction in losses due to tax fraud

- Increase in productivity in tax administration

Conclusion

An improvement to the GST structure is GST e-invoicing. Its goal is to streamline the GST system’s process for reporting business-to-business (B2B) supplies. The government can stop unwanted data breaches and inaccuracies by implementing the e-invoicing standard.