Do you bank with Indian Overseas Bank? If so, you’re in for a treat! The bank’s mobile app offers many features and services that will improve your banking experience.

You can use IOB Net Banking to conduct most financial transactions, keep up with the digitalization trend, and more. This blog post will explain what IOB Net Banking is, show you how to register for it, and reveal some of its key advantages.

So, whether you’re looking to pay your credit card bill or see your latest transaction history, read on to learn all you need to know about IOB Net Banking!

Table Of Content

- Indian Overseas Bank Net Banking

- Features of IOB Net Banking

- How To Login for IOB Net Banking?

- How To Register for IOB Net Banking?

- How To Register for IOB Net Banking Via Phone Banking?

- How To Register for IOB Net Banking at The Bank’s Branch?

- How To Reset Indian Overseas Bank Net Banking Password?

- Transfer of Funds via IOB Net Banking

- Payment of credit card bills via IOB Net Banking

- What Are the Advantages of IOB Net Banking?

- Disadvantages of Indian Overseas Bank Net Banking

- FAQs of IOB Net Banking

- Conclusion

Features of IOB Net Banking

If you’re looking for an online banking solution that is convenient, secure, and easy to use, look no further than IOB Net Banking. Registered users can access your account from anywhere in the country through our secure network.

You can also track your transactions and payments history to keep everything in order. The following are some examples of services that fall within this category:

- With the help of the internet banking service provided by the financial institution, the customer may effortlessly send and receive money.

- The user has access to a great deal of information on their account. Take, for instance:

- Specifics on the most recent financial dealings

- Cheque book request

- The current status of a cheque’s payment

- Balance inquiry

- Put an immediate hold on the IOB Debit Card.

- Look at the account for the PPF.

- The user can make various online payments, including tax payments (direct taxes, indirect taxes, sales tax collections, e-payments, Jharkhand VAT), contributions, subscriptions, and so on, when they have access to the net banking facility.

- Additionally, utility payments may be performed via the internet banking account (gas, water, electricity, etc.).

- The customer can also make payments for DTH or Internet costs, insurance premiums, Fastag Recharges, mobile prepaid or post-paid payments, credit card payments, and many other types of payments.

- The user can connect all their bank accounts (loans, insurance, FDs, RDs, etc.) to a single login and access them via a single net banking account.

- Additionally, net banking users can apply for loans and create new fixed or recurring deposits online.

In addition to account opening, transaction processing, and other features, IOB Net Banking offers various beneficial services like account management and mobile banking.

So, whether you’re looking to save time or manage your finances more effectively, IOB Net Banking is perfect!

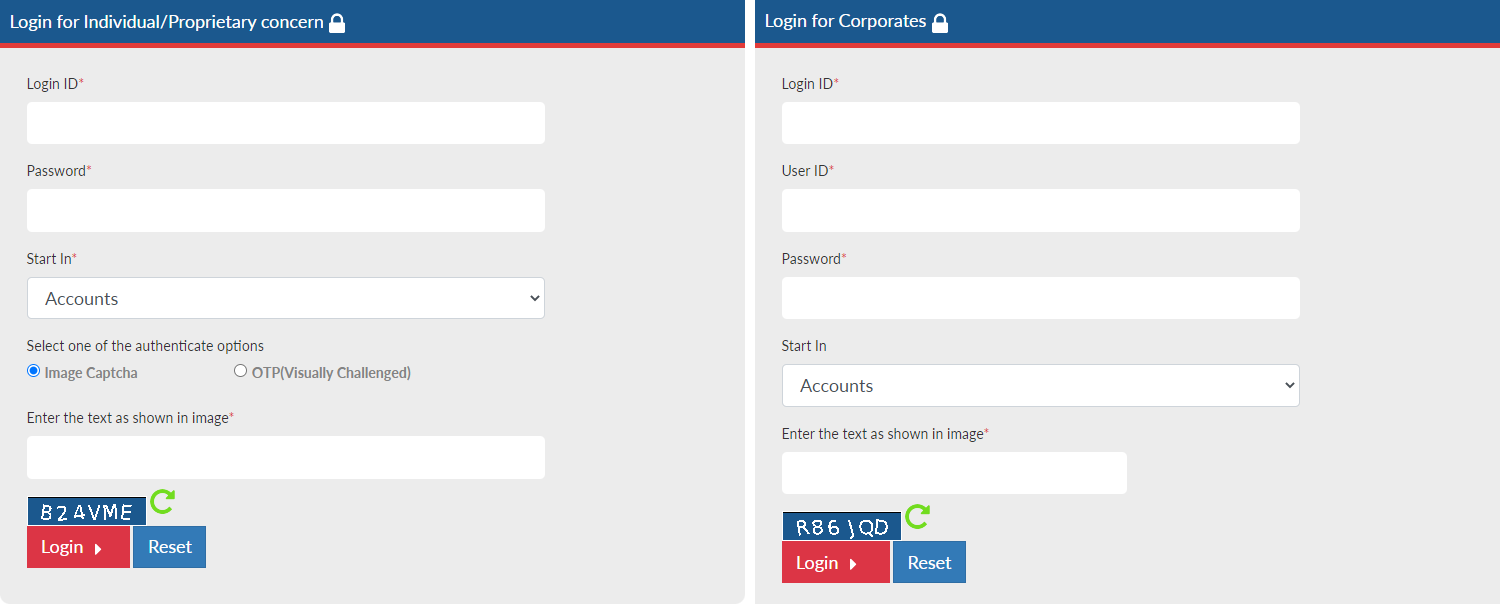

How To Login for IOB Net Banking?

To login on to the IOB net banking account, you need to follow the following steps:

Note: In the case of “Corporate Login”, you need to enter your Login ID, User ID, password and Captcha.

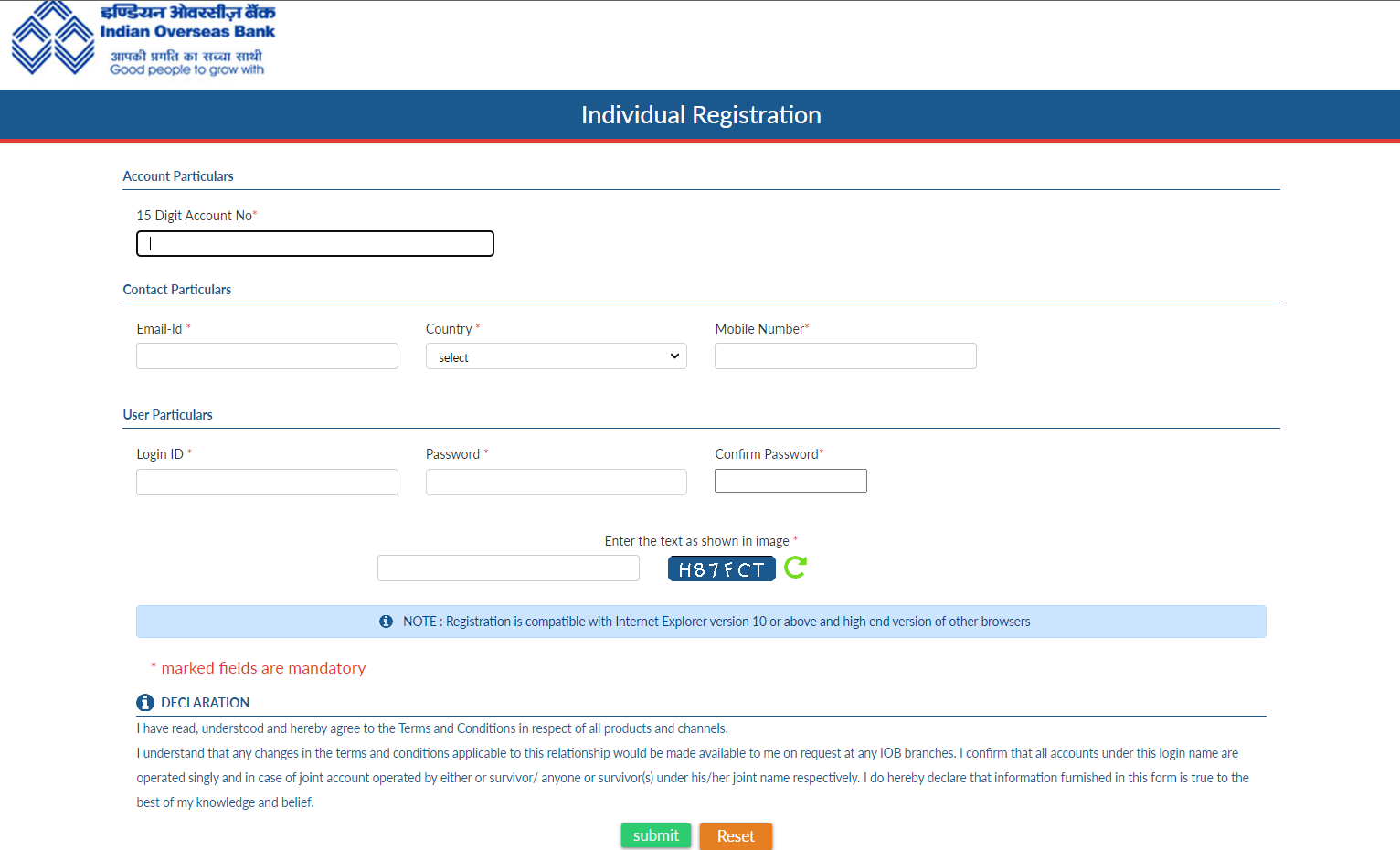

How To Register for IOB Net Banking?

The registration process is simple if you are looking to bank with IOB. You can also find all the essential information on their websites, like account features, banking products, and services.

- Navigate to the IOB website that is officially sanctioned.

- Pick retail banking from the dropdown menu after clicking the register button

- After clicking the link that says “Register Online/Self user registration,” you will be sent to the website where you can complete the self-register process.

- Read through the terms and conditions, decide whether or not you agree with them, and proceed.

- Please provide the needed information, choose the appropriate facility type, configure your login information, and click the “Submit” button.

- Your user/login ID and reference number will be shown after the successful submission of your form. Keep this in mind for future reference.

- When your net banking login has been successfully authorized, an SMS will be sent to the cell phone number you have registered with us.

- After an hour, you can log on to IOB online banking and immediately begin doing transactions.

How To Register for IOB Net Banking Via Phone Banking?

ICICI Bank is one of the biggest banks in the world and offers its customers several banking and financial services. One such service is IOB Phone Banking.

- Call the IOB customer service phone banking number at 18004254445 if you have any questions or concerns.

- Either provide your customer identification number and your Telephone Identification Number (TIN) or verify the specifics of your bank account.

- Your desire to register for online banking will be considered by the customer care executive.

- After that, the bank will send your net banking password to the address you provided by the postal service.

How To Register for IOB Net Banking at The Bank’s Branch?

If you’re looking to bank online, IOB Net Banking is the perfect service for you! This new banking service allows you to carry out transactions quickly and easily from any device.

- Visit one of the IOB Bank branches and ask an employee there for the paperwork to register for online banking (individual or corporate).

- Complete the form in its entirety, then hand it to the official working at the IOB branch.

- Following the completion of the procedure, an SMS containing the user/login ID will be sent to the cell phone number registered for you.

- Within seven to ten business days, both your login password and transaction password will be sent to the address you provided at registration through expedited mail.

- Following the transmission of your password from the CPC, an SMS will be issued to the cell phone number that you have registered for it. The speed post tracking number will be included and sent to you for reference.

- To performs a financial transaction with IOB Net banking, you will need the user/login ID, the password for the login, and the transaction password.

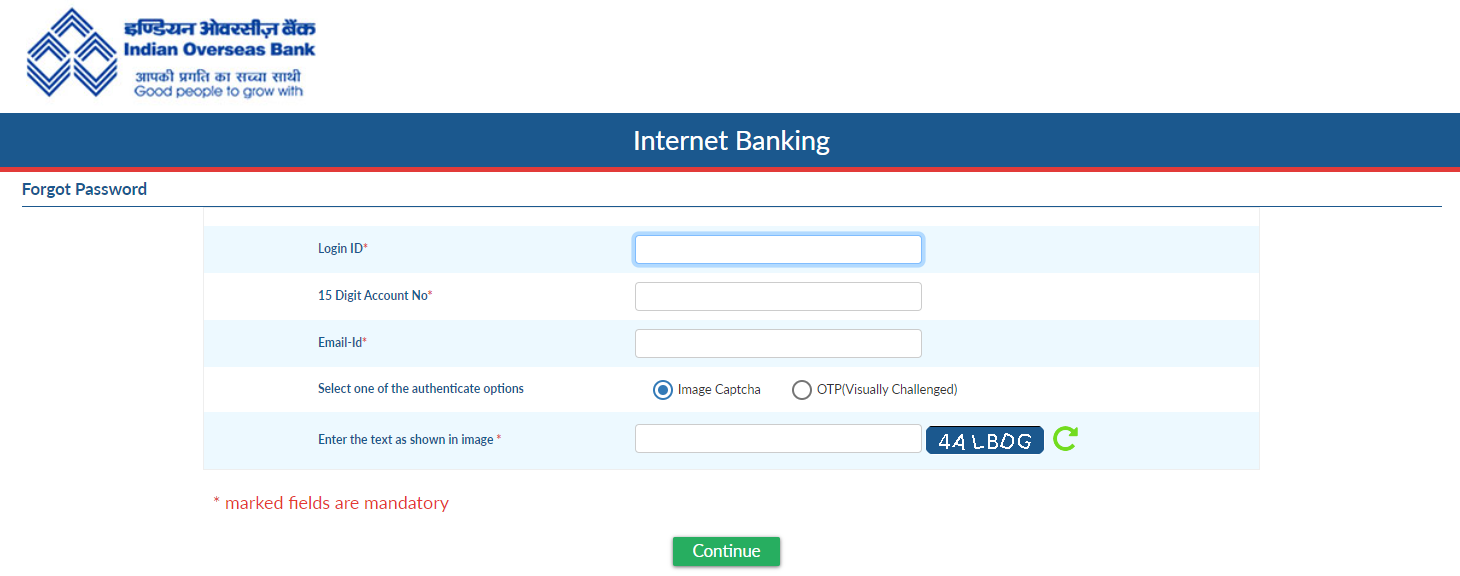

How To Reset Indian Overseas Bank Net Banking Password?

If you have forgotten your IOB bank password and want to reset it, you need to follow the following steps:

Transfer of Funds via IOB Net Banking

There’s no need to go through the hassle of visiting a bank or standing in long queues. With IOB net banking, the transfer of funds process is straightforward and can be completed in a few minutes.

The following outlines the steps involved in making a transfer using the internet banking function.

- To commence the transfer of money to any account, the user must first be able to successfully log in to their net banking account using their user id and password.

- If an account has already been designated as a beneficiary for the user, then the user will not be able to transfer money to that account.

- After adding a new payee, there is a waiting time before cash may be sent using the online banking account. Once this waiting period has passed, it is possible to make the transfer.

- The user must click on the remittances tab after successfully logging into their online banking account.

- After adding a new payee, there is a waiting time before cash may be sent using the online banking account. Once this waiting period has passed, it is possible to make the transfer.

- The user will be required to provide information on the account from which the funds are to be moved, the version to which the funds are to be transferred, and the amount of such a transfer, and then click on the button labelled “proceed.”

- After that, the user will be prompted to provide their identification number (PIN) to validate the money transfer, after which they will be given a choice to transfer the funds.

- The transfer will be performed once the transaction is validated using the input OTP. The user will get a confirmation for the same along with the transaction details such as the transaction number, date of transfer, payee details, and other relevant information.

Payment of credit card bills via IOB Net Banking

The customer can pay credit card dues at any bank using the IOB’s online banking system, which may be accessed through net banking. This section discusses the procedure for making such a payment.

The user will first be required to establish a login for the internet banking site and then add the credit card as a beneficiary or payee for the money transfer.

The user can make the payment for the credit card bill after the cooling-off time has passed and the credit card added as the beneficiary has been authorized.

Once the user has successfully logged into their online banking account, they need to go to the money transfer area and choose the NEFT option to complete the transaction.

- The user will be responsible for providing accurate information according to the following prompts:

- The name of the bank of destination

- IFSC code

- Name of the last branch of the destination

- Number of the destination account (16-digit credit card number)

- Amount that will be sent over (paid)

- Transaction code

- The user will then be required to verify the information they put on the subsequent page..

- For the user to get the OTP, they will also be required to provide the cell phone number that has been registered.

- The one-word (OTP) obtained will be required as part of the authentication process for the transfer.

- Following the successful verification of the transaction, the user will be sent a message confirming the transaction.

What Are the Advantages of IOB Net Banking?

Suppose you’re looking for a banking service that’s user-friendly, easy to use, and provides a better experience than traditional banking services. In that case, IOB net banking is the perfect option for you.

The following is a list of the benefits of using the Indian Overseas Bank’s online banking service:

- 24/7/365 Availability: Internet banking services may be accessed anytime throughout the year. You can use most of the given services whenever you see fit.

- Easy to Operate: IOB Bank’s Internet Banking services are straightforward and user-friendly, making it easy to take advantage of their benefits. Many people believe that doing business online is more convenient than going to the branch.

- Convenience: It’s possible that going to the bank’s branch won’t always be possible for you. You can do business regardless of where you currently are.

Using net banking, you can make payments for recurrent expenses like utility bills or deposits into recurring deposit accounts, transfer cash, and check your account balance whenever you want.

- Time Efficient: Online banking allows you to finish any transaction promptly, saving you a significant amount of time compared to traditional banking methods. You can rapidly create a fixed deposit account via net banking and may transfer funds to any account located inside the nation.

- Activity Tracking: If you complete a transaction at the IOB branch, you will be given a receipt to acknowledge completing the transaction. You may misplace or lose this. However, the site will keep a record of your internet banking transactions. If you show it to them, this may serve as evidence of the trade.

In addition, details such as the payee’s name, the amount paid, the payee’s bank account number, the date and time of the payment, and any comments that may have been made will be noted.

Disadvantages of Indian Overseas Bank Net Banking

If you’re looking for an overseas bank account, IOB is a popular choice. Their net banking service is user-friendly and offers a variety of banking options. The following items are included among the drawbacks of using IOB net banking:

- It does not provide complete protection as banks, giving customers encrypted websites to perform their commercial transactions.

- New consumers may find that it takes time before they are comfortable using online banking. Customers must invest their time learning how to utilize net banking, which might be inconvenient.

- Because hackers steal confidential financial information online, net banking is vulnerable to fraud.

- Internet access in rural locations is restricted, making it difficult to use the internet. Therefore, it may be challenging for those living in remote areas to utilize internet banking to conduct financial activities.

FAQS of IOB Net Banking

What is IOB internet banking?

IOB Internet Banking is an internet banking service that allows bank customers to access and manage their accounts 365 days a year.

What advantages does IOB internet banking offer?

Access of account 24X7

Easy transfer of funds

Quick bill payments & recharging

Anytime account tracking and checking balance

Simple to use

What are the advantages when using IOB Internet Banking?

Balance enquiry

Last Few transactions

Account Statement

Cheque Paid Status

Deposit Opening

Deposit Closure/Deposit Renewal

Transfer money to any of your bank accounts

What is the registration process for IOB Net Banking?

The registration process can be done in two steps:

Step 1:

A. Login to www.iobnet.co.in

B. Click “Register Individual” if you are an individual or a proprietary firm. ( Else click on “Register Corporate.”)

C. Once registered, submit the application forms to the Account holding branch.

D. An active E-mail id is necessary to open internet banking.

E. Note down the PIN to be used for all Funds transfer transactions.

F. Your Account will be activated by the branch on receipt of the application.

Note : (Don’t share this with anyone)

Step 2:

A. Log in with your password.

B. Passwords are case-sensitive (b is different from B)

C. Login Password & transaction PIN are different where the password is used for logging in and the PIN for funds transfer.

Note: Please be careful when entering your passwords. If you regularly input your passwords incorrectly, your internet account maybe blocked.

What is E-Token?

Currently E-token is issued for corporate only. It is a small USB device that contains a digital certificate and is sent to the customer. To secure your account during login and money transactions, it will be used as a second authentication method in addition to your password.

1. To apply for E-Token, you need to follow the following steps:

2. Login to internet banking –> accounts –> apply for digital signature

3.Fill form online & submit.

4. ITD processes the request and sends the eToken by post.

5. On receipt of eToken, log in to see a “Register Certificate” link on home page.

6. Fill details to activate the token.

Note: Rs 625 is charged per token. A separate token is to be used by each user of a corporate login

How is an IOB account for online banking activated?

Once the branch receives the application, it will activate the account. An email will be delivered after the account has been activated.

If the account is still inactive after submitting the application form to the branch, do email the IOB bank with the account details to eseeadm@iobnet.co.in or call them at 044-28519460/28889350.

How do I access Internet Banking? How should I proceed if I experience difficulties logging into IOB internet banking?

1. Make sure your computer is linked to the internet.

2. Also, make sure your LAN or ISP is linked to the internet.

How is the online banking account deactivated?

1. Access your online banking account.

2. In the “Edit Profile” link,

3. Choose Deactivate account.

4. Click “submit” after selecting the proper account to deactivate.

How can the daily limit be modified using internet banking?

1. Sign in using your Internet Banking credentials.

2. In the “Edit Profile” link,

3. Select the “Change Daily Limit “option.

4. Click “submit” after entering the Account number and daily cap in the appropriate fields (upto two lakhs).

Can I change my IOB net banking password?

1. Access your Internet Banking profile.

2. In the “Edit Profile” link,

3. Choose “Change Password” from the menu.

4. Then click “submit” after entering the old and new passwords in the appropriate sections.

Can my PIN be modified?

1. Access your online banking account.

2. In the “Edit Profile” link,

3. Choose “Change Pin”.

4. The new pin and the current pin are in the appropriate fields.

5. Click “submit”.

My Funds Transfer PIN is lost. Is there any provision for this?

1. Access your online banking account.

2. In the “Edit Profile”, Select “Forgot Pin”.

3. An OTP window will appear.

4. Click “submit.”

5. Once the OTP has been validated, a pin will be issued to the registered email address.

How can I proceed if I forget my password?

1. Click on the forgot password link in the login window.

2. Enter the login id Screen prompts to enter the email address.

3. Enter the email id registered with the bank

4. If the login id and email address match the bank’s record, OTP will be sent as an SMS to the registered mobile number.

5. Enter the OTP.

6. Click on submit New Password will be sent to the registered email id.

What should I do if I suspect my password has been changed?

Change your password immediately, then call or email us at 044-28519460/28889350 or eseeadm@iobnet.co.in to let customer support know about the matter.

What security features are present in IOB internet banking?

IOB has established several security safeguards, including :

1. 128-bit SSL encryption, which is extremely safe.

2. Password, login ID, and two-factor authentication.

3. Automatic session termination feature after 5 minutes of inactivity.

What happens if my mobile phone linked to the SIM card number for online banking is stolen, lost, or broken?

Please notify the bank immediately to withdraw transaction permissions on your online account because the bank uses the mobile phone number you registered with them to send you One Time Passwords (OTPs) when you conduct online transactions.

How can I use Internet banking to register a digital certificate for use in secure transactions?

1. Login to Internet Banking accounts with user id, login id, and password.

2. Go to “Accounts”.

3. Select the name of the certifying authority, Browse and Upload the .CER file.

4. Click on the “submit” button.

How do phishing attacks work? How can I report these attacks?

Phishing attacks are attempts to obtain sensitive customer data via email using fake business email sender addresses, such as usernames, passwords, and credit card numbers. These attacks use fake email addresses from businesses the customer is familiar with and trusts.

Please report any allegedly fraudulent emails to Indian Overseas Bank at eseeadm@iobnet.co.in or by calling 044-28519460.

How can I find out my balance?

To check balance:

1. Log in to Internet banking with login id and password.

2. Select Accounts –> Balance enquiry.

How do I view my most recent completed transactions?

To check the last few transactions:

1. Log in to internet banking with login id & password

2. Select Accounts –> Last few transactions.

Am I able to view/print my account statement?

To view or print the account statement:

1. Log in to internet banking with login id and password.

2. Select Accounts –> Account Statements –> view/print.

3. Select the account, from date and to date, for which statement is required.

4. Click on submit.

Can I check my internet banking to see if my cheque has been paid?

1. Log in to internet banking with login id and password.

2. Select Accounts –> Search Cheque Paid.

3. Select the account type and date and enter the cheque number.

4. Click on submit.

Can I access internet banking to check the status of my loan or deposit account?

1. Log in to internet banking with login id and password.

2. Select Accounts –> Loan/deposit view.

3. Select the account.

4. Click on submit.

Can I know my 15-digit account number through IOB internet banking account?

1. Log in to Internet banking with the registered login id and password.

2. Go to ” Remittances Menu”.

3. Select the 15-digit account number option

4. Enter the account number, branch name and account type.

5. Click on Submit

How can I access my internet banking account’s PPF loan accounts?

Log in to internet banking with login id and password.

Select Accounts –> PPF Loan/deposit view.

Select the account, from date and to date, for which statement is required.

Click on submit.

How are accounts added to an online banking account?

1. Select Edit Profile.

2. Add Accounts Provide the details of the accounts to be added.

Can I end or renew a deposit account using online banking?

Yes. Deposit accounts may be closed or renewed within 10 days of maturity.

Can I submit an ASBA application using online banking?

1. Yes. Login to internet banking using a registered login id and password.

2. Select Remittances –> Apply for ASBA.

3. Select the Depository name NSDL or CDSL.

4. Enter the Depository id, client id, and beneficiary account number.

5. Select the status of the bidder as a resident or non-resident.

6. Enter the PAN number and name and click on the submit button.

How can I protect my online banking account?

1. Watch out for spam emails that link to a malicious link or contain a virus.

2. Maintain the privacy of your login information, password, and pin.

3. Change your pin and password frequently.

4. Please do not share them with anyone, not even the Bank staff.

5. For your password, choose a combination of letters and digits.

6. To enter your password securely, use the virtual keyboard that is supplied.

What should I do if I think my account has been used fraudulently?

Don’t hesitate to contact the Bank immediately at eseeadm@iobnet.co.in if you believe there has been an unlawful transaction in your account.

Is it possible to start a deposit account using online banking?

1. Log in to internet banking using a registered login id and password.

2. Select Remittances –> Deposit –> Open.

3. Select the account number for which the deposit is to be opened.

4. The name of the depositor is displayed.

5. Enter the scheme code, amount of deposit and tenure of the deposit.

6. On the next screen, enter the PIN and Click on submit button.

Can I close/renew a deposit account using internet banking?

Yes. Deposit accounts may be closed or renewed within 10 days of maturity.

Can I submit an ASBA application using online banking?

1. Login to internet banking using registered login id and password.

2. Select Remittances –> Apply for ASBA.

3. Select the Depository name NSDL or CDSL.

4. Enter the Depository id, client id, beneficiary account number.

5. Select the status of the bidder as resident or non-resident.

6. Enter the PAN number, name

7. Click on the submit button.

How can I add a payee to my internet IOB banking account?

1. Login to internet banking using login id and password

2. Select Remittances –> add payee –> IOB account

3. Enter the name and account number of the person and click on submit.

4. In next screen, enter the OTP (one time pin) that you have received on your mobile and email id.

5. Click on “approve payee”.

How to add other bank payee in IOB internet banking account?

1. Login to internet banking using login_id and password

2. Select Remittances –> add payee –> other bank account

3. Enter the beneficiary details like name, address, account type, account number and IFSC code for the bank

4. Click on submit.

5. In next screen, enter the OTP (one time pin) that you have received on your mobile and email id

6. Click on “approve payee”.

How do I delete the IOB Account payee from my internet banking account?

1. Login to internet banking using registered login id and password

2. Select Remittances –> remove payee –> IOB account Payee Account name, number , type and status are displayed to the user

3. Select the Payee account to be removed and click on delete.

How do I delete other bank payees from my internet banking account?

1. Login to internet banking using registered login id and password

2. Select Remittances –> remove payee –> other bank account Payee Account name, IFSC Code, Account number ,Account type and status are displayed to the user

3. Select the Payee account to be removed and click on delete.

How can I transfer money to an IOB account using IOB internet banking?

1. Select Remittances –> Funds Transfer –> IOB account

2. Select the debit account, credit account, amount and narration for debit and credit entries

3. Click on proceed Enter the funds transfer pin

4. Click on Pay Now/Schedule Later Screen will prompt for OTP.

5. Enter the OTP received through mobile and click on submit.

My NEFT times have finished. Can I send money via IMPS?

Yes. After NEFT Timings, funds can be transferred using IMPS (available 24/7).

What is 2FA?

You will receive an SMS containing an OTP as part of 2FA on the mobile number you registered with IOB to use for internet banking transactions. The authentication procedure verifies the customer’s claimed identity by confirming what the customer knows and what the customer has on his mobile phone.

What is One Time Password (OTP)?

It is a 4-digit code password valid for only one login session or transaction. It is a special password with a time limit used for Internet banking as an extra layer of security.

I am not able to receive OTP on time to my mobile. Is there any voice number?

Yes, there is voice number 09289034567.Validity is 180 seconds. Call to be made to VMN only from registered Mobile number

How to register my credit card in IOB internet banking?

1. Login to Internet banking.

2. Select IOB Card –> IOB Credit Card –> Register card.

3. Enter the card number and cardholder’s name as appears on the card and select confirm.

How do I use IOB Internet Banking to pay my credit card bills?

1. Login to Internet banking.

2. Select IOB Card –> IOB Credit Card –> Make Payment

3. Select the debit, credit account and enter the amount to be paid.

4. Enter the Pin for making the transaction.

Through my IOB internet banking account, can I suspend my debit card?

1. Login to Internet banking.

2. Select IOB Card –> IOB Debit Card –> suspend debit card.

3. Select the debit card to be suspended.

4. Click on submit.

How should a batch file for IOB accounts remittance be created?

1. Ensure the file is a CSV (comma separated values) or TXT file (fore.g. IOBTest.csv or IOBTEST.txt)

2. Each transaction is represented as a row in the file

3. Each row should contain 15 digit account number and amount

4. The amount should be specified with the decimal point for paisa.

5. Sample :

6. 15480100002211,2500.00

7. For each credit transaction a similar row as of the above should appear in the CSV or TXT file which is to be uploaded

8. All the values must contain alphabets and numbers only. No special characters allowed

Comma (,) should only be used as a field separator between account number and amount.

How can I modify the batch that was created in internet banking?

1. Login to internet banking using registered login id and password.

2. Select Remittances –> Bulk Remittances –> IOB Account –> modify batch.

3. Select the corresponding batch and click modify batch.

4. Enter the funds transfer pin and submit with the option “pay now or later “.

5. Click delete batch to delete the corresponding batch.

How to do bulk remittance to the other bank Accounts?

1. Create batch Login to internet banking using registered login id and password

2. Select Remittances –> Bulk Remittances –> other bank Account –> create batch.

3. Enter the bulk file name and select upload file to Upload the bulk file

4. Click on upload file.

5. Execute Batch Login to internet banking using login id and password.

6. Select Remittances –> Bulk Remittances –>Other Bank Account –> execute batch.

7. Select the batch and click on “ execute batch “.

What are the instructions to create a batch file for other bank accounts remittance?

1. Ensure the file is a CSV(comma separated values) or TXT file (for e.g. IOBNEFTTest.csv or IOBNEFTTest.txt)

2. Each transaction is represented as a row in the file

3. Each row should contain

4. IFSC Code – should be exactly 11 characters

5.Account Type

6. Account Number – should not exceed 35 characters

7. Name of the Beneficiary – should not exceed 35 characters

8. Address of the Beneficiary – should not exceed 140 characters

9. Sender Information – should not exceed 210 characters

10. Amount – should not exceed 15 plus 2 decimals

11. 10 – savings account 11 – current account 12 – overdraft account 13 – cash credit account 14 – advances 40 – NRE savings 52 – credit card

How do I use IOB internet banking to pay direct taxes?

1. Please visit https://onlineservices.tin.nsdl.com/etaxnew/Index.html and click link

2. Select applicable Challan

3. Fill up the Challan particulars and choose Indian Overseas Bank

4. Fill up amount details

5. Enter the PIN and submit

6. In case of single level authorization, account is debited and cyber receipt generated online

7. In case of multi level authorization, transaction is made as pending and next user can log into his corporate8. login and pass the transactions available under direct tax -> pending transactions

8. You can view / re-print cyber receipt for past transactions under direct tax – print cyber receipt

Conclusion

After reading through this blog, you will be well-equipped with all the information you need to start using IOB NetBanking. This popular banking service offers a range of features and services perfect for online banking fans.

In addition to registering, logging in, and transacting, IOB Net Banking provides customer care services that can help resolve any issues. If you have any questions or comments, please let us know in the comments below!