Imagine you run a business and have outstanding invoices from your customers. These invoices represent money you’re owed, but until your customers pay, that money is tied up and unavailable.A cash flow bottleneck may result from this, particularly for small and medium-sized enterprises (SMBs). A remedy is provided via invoice discounting. It allows businesses to convert their unpaid invoices into immediate cash by selling them to a financing company at a discounted rate.

Traditionally, invoice discounting involved complex procedures and limited accessibility. But since online invoice discounting platforms have grown in popularity in India, the procedure is now quicker, easier to use, and available to a larger variety of companies.

Read Also The Complete Guide on Bill Discounting

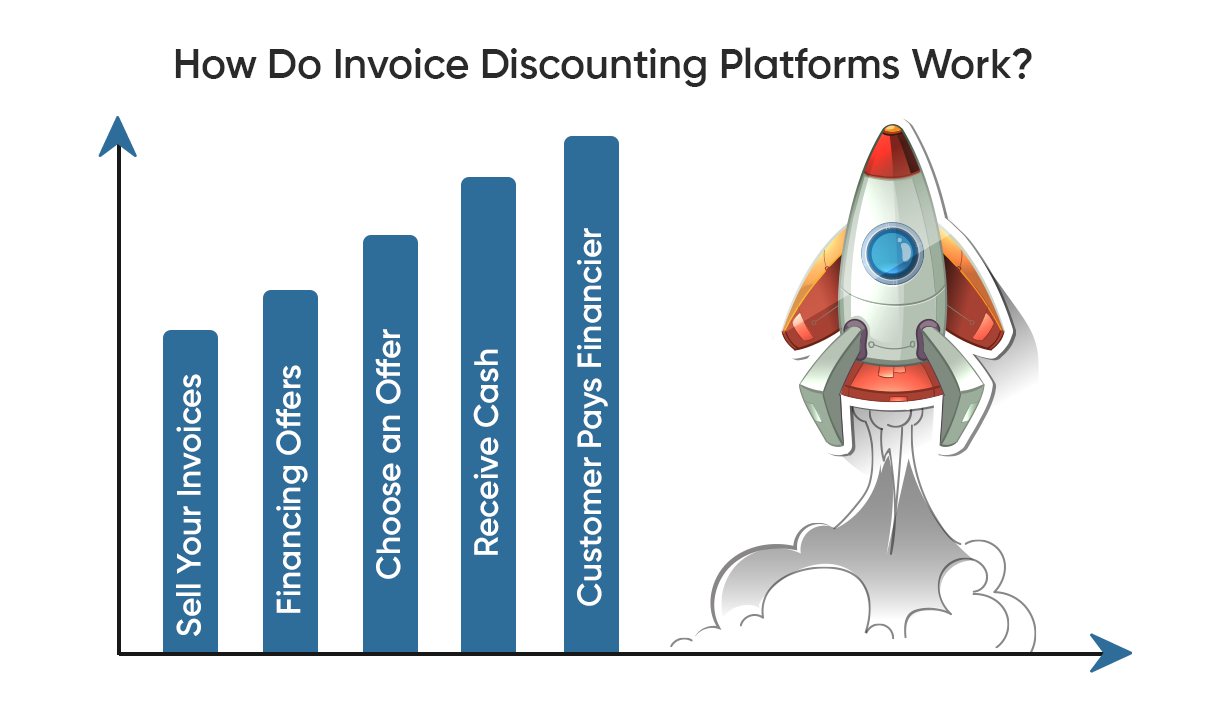

How Do Invoice Discounting Platforms Work?

Platforms for online invoice discounting serve as markets, linking companies with lenders. Here’s a condensed explanation:

- Sell Your Invoices: Businesses upload their unpaid invoices to the platform.

- Financing Offers: Financiers (investors or financial institutions) on the platform review the invoices and offer their discounted rates for purchasing them.

- Choose an Offer: The business can choose the offer with the most favorable terms (discount rate and fees).

- Receive Cash: Once an offer is accepted, the platform facilitates the transaction. The business receives immediate cash, minus the discount fee.

- Customer Pays Financier: The platform collects payment from the business’s customer and settles the remaining amount with the financier.

These platforms essentially streamline the invoice discounting process, offering greater transparency and wider access to financing options for businesses.

Top Invoice Discounting Platforms in India

There are two main categories of online invoice discounting platforms in India:

A. Trade Receivables Discounting System (TReDS) Platforms:

TReDS is a government-backed initiative that facilitates secure and transparent invoice discounting for MSMEs. This platform allows MSMEs to get money quickly by selling their unpaid bills or invoices to finance companies like banks, instead of waiting for the full payment period from the large corporate buyers.

A major benefit of TReDS is that it verifies the genuineness of the invoices and checks the creditworthiness of the corporate buyer before providing financing.

The entire process happens online through the TReDS platform under the supervision of regulatory bodies, ensuring a fair and transparent system for all parties involved – the MSME sellers, corporate buyers, and finance companies.

By bringing multiple finance companies onto one platform, TReDS creates competition which can lead to better rates for the MSMEs when they sell their invoices.

TReDS helps address the problem of delayed payments that MSMEs often face when dealing with large corporations. Instead of waiting months, they can get paid upfront by discounting their invoices.

However, currently only certain sectors are allowed to use TReDS, and both the MSME and the corporate buyer have to be registered on the platform. Here’s what you need to know:

Role of TReDS:

These platforms connect MSMEs as sellers (billers) with large corporations (buyers) and financiers (factors).

- TReDS acts as a digital marketplace where MSMEs can sell their unpaid bills or invoices to financiers. The financiers then provide funding to the MSMEs upfront, instead of them having to wait for the full payment period from the corporate buyer.

- This helps MSMEs get access to working capital quickly, improving their cash flow situation. The large corporate buyers also benefit by getting extra time to make payments.

- The entire process happens online through the TReDS platform in a transparent manner overseen by third parties like banks.

Major TReDS Platforms in India:

- M1xchange

- Receivables Exchange of India Ltd (RXIL)

- A Treds Limited (Invoicemart)

Advantages of TReDS: Offers greater security and standardization for invoice discounting, especially for transactions involving large corporations. TReDS provides a safe and uniform way for companies to get money by selling their invoices or bills before the due date. This is mainly helpful when dealing with big businesses.

Limitations of TReDS: Participation is currently limited to specific sectors and requires both the buyer and seller to be registered on the platform. This improves their money flow situation.

B. Fintech Invoice Discounting Platforms:

Fintech (financial technology) companies offer innovative solutions for invoice discounting. These platforms provide an online marketplace where businesses can get financing by selling their unpaid invoices or bills to investors and lenders.

A key advantage is that fintech platforms connect businesses with a wider pool of financiers beyond just banks. This includes non-banking financial companies (NBFCs), institutional investors, as well as individual investors interested in funding invoices.

By increasing the number of potential funders, businesses may be able to access more competitive discount rates when selling their invoices compared to going through traditional bank channels alone.

The digital nature of fintech platforms makes the process convenient as businesses can submit invoice details and receive funding online without physically visiting any office.

Many platforms use technology like data analytics to evaluate the creditworthiness of the businesses and the likelihood of their customers paying the invoices on time.

Some fintech invoice discounting solutions also provide value-added services like online document management, automated reminders to customers for payment, and dashboards for tracking cash flow.

While offering more options, these platforms still maintain standards by verifying invoices and conducting due diligence on participating businesses and funders. Here’s how they fit in:

Role of Fintech Platforms: These platforms connect businesses of all sizes with a wider pool of financiers, including banks, non-banking financial institutions (NBFCs), and individual investors.

- Fintech platforms provide an online marketplace where businesses, whether big or small, can access funding from various sources.Traditional banks, specialized non-banking financial corporations (NBFCs), and private investors seeking to extend credit are some examples of these sources.

- Fintech solutions help businesses find appropriate finance choices that meet their needs by connecting capital-seeking firms with various types of financiers on one platform.

- The platforms use technology to simplify and speed up the application and approval processes for loans or other financing products. Businesses can submit their requests online, and financiers can evaluate and respond quickly.

- Additionally, fintech platforms often have partnerships with multiple lenders, giving businesses more choices compared to going to a single bank. This increased access to capital can support business growth and operations.

- The online nature of these platforms also makes the process more convenient and accessible for businesses located in different parts of the country or world.

Leading Fintech Invoice Discounting Platforms:

- KredX

- Oxyzo

- FactorChain (focuses on large-ticket invoices)

- InvoPay (known for its user-friendly interface)

Advantages of Fintech Platforms:

- Faster turnaround time compared to traditional methods.

- Wider investor base, potentially leading to more competitive discount rates.

- Additional features like online document management and credit risk assessment tools.

- Increased transparency in the funding process. Fintech platforms make the funding journey more clear by providing updates and visibility into the different stages from application to approval.

- Accessibility for businesses of all sizes. Smaller businesses that may face challenges getting funding from banks can access fintech platforms to find alternative financing options.

- Use of technology reduces manual effort. The online nature and automation helps cut down on paperwork and manual processes involved in traditional financing methods.

- Opportunity to build credit history. By facilitating funding, these platforms allow businesses to develop a track record which can improve their chances of securing future capital.

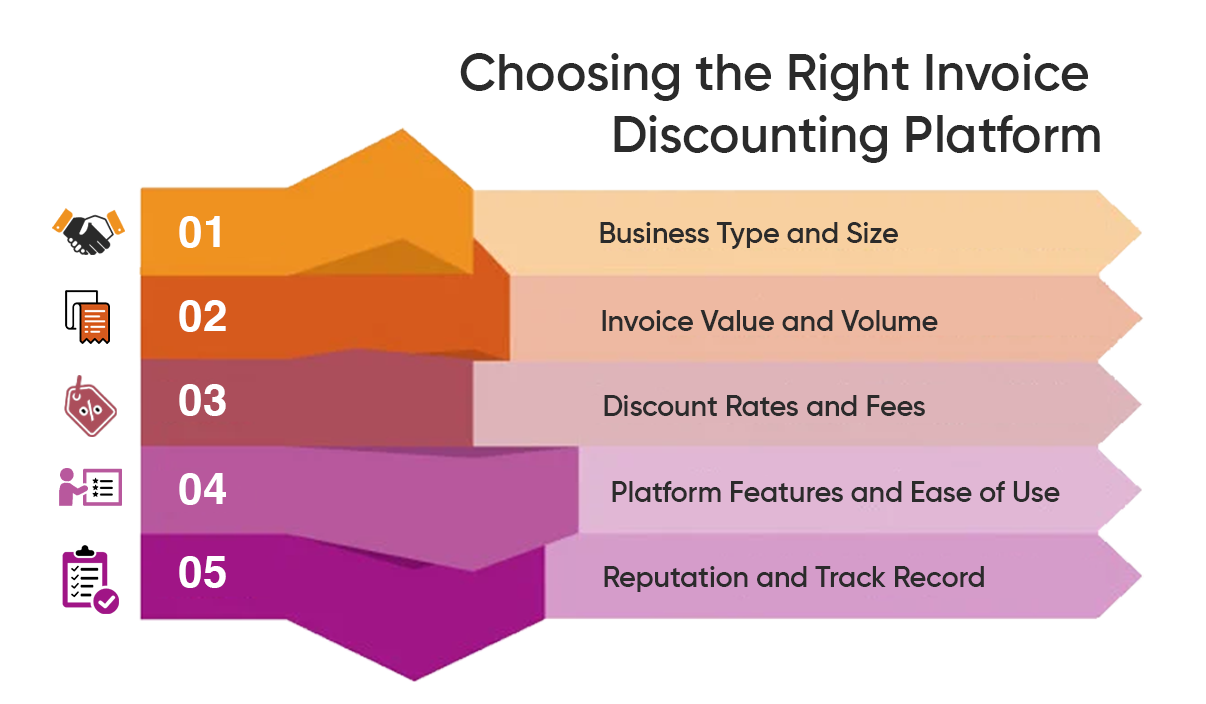

Choosing the Right Invoice Discounting Platform

Selecting the most suitable platform depends on your specific needs. Here are some factors to consider:

- Business Type and Size: TReDS platforms might be better suited for MSMEs selling to large corporations, while Fintech platforms offer wider options for businesses of all sizes.

- Invoice Value and Volume: Platforms might have minimum invoice amounts or limitations on the number of invoices processed.

- Discount Rates and Fees: Compare the discount rates and associated fees offered by different platforms.

- Platform Features and Ease of Use: Consider the platform’s user interface, available features (e.g., credit risk assessment), and ease of uploading and managing invoices.

- Reputation and Track Record: Research the platform’s reputation, experience, and client testimonials.

Leveraging Invoice Discounting Platforms Effectively: Beyond the Basics

Having explored the top invoice discounting platforms and the factors to consider when choosing one, let’s delve deeper into how businesses can leverage these platforms effectively:

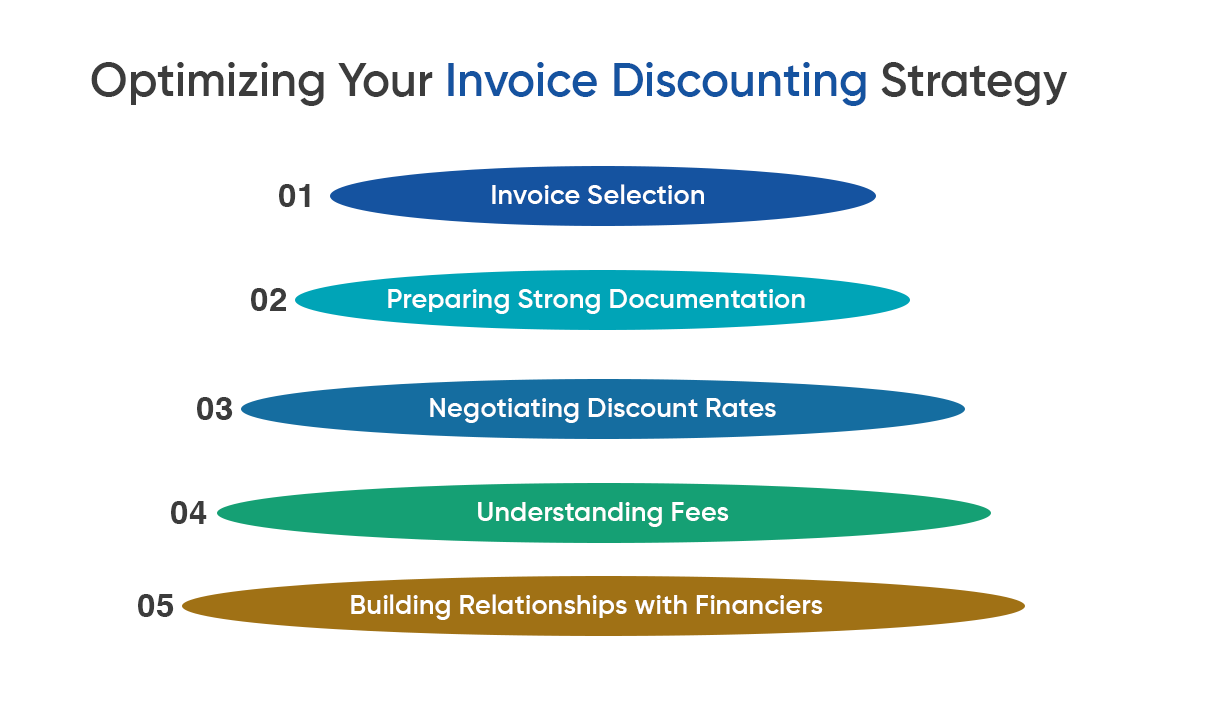

Optimizing Your Invoice Discounting Strategy:

- Invoice Selection: Not all invoices are created equal. Choose invoices from creditworthy customers with a good track record of timely payments. Avoid invoices with extended payment terms or those at high risk of defaults.

- Preparing Strong Documentation: Ensure your invoices are accurate, complete, and contain all necessary details (invoice number, date, customer information, product/service description, amount due). Clear and well-presented invoices make the process smoother and attract more competitive offers.

- Negotiating Discount Rates: Don’t settle for the first offer you receive. Compare rates from different financiers and negotiate for the best possible discount rate based on your invoice quality and creditworthiness. Utilize the platform’s competitive environment to your advantage.

- Understanding Fees: Be mindful of the associated fees charged by the platform and financiers. These can include processing fees, transaction fees, and potential late payment charges if your customer delays payment. Factor these fees into your calculations when evaluating the overall cost-effectiveness of invoice discounting.

- Building Relationships with Financiers: Develop positive relationships with financiers on the platform. Prompt repayments and clear communication can build trust and potentially lead to more favorable terms in future transactions.

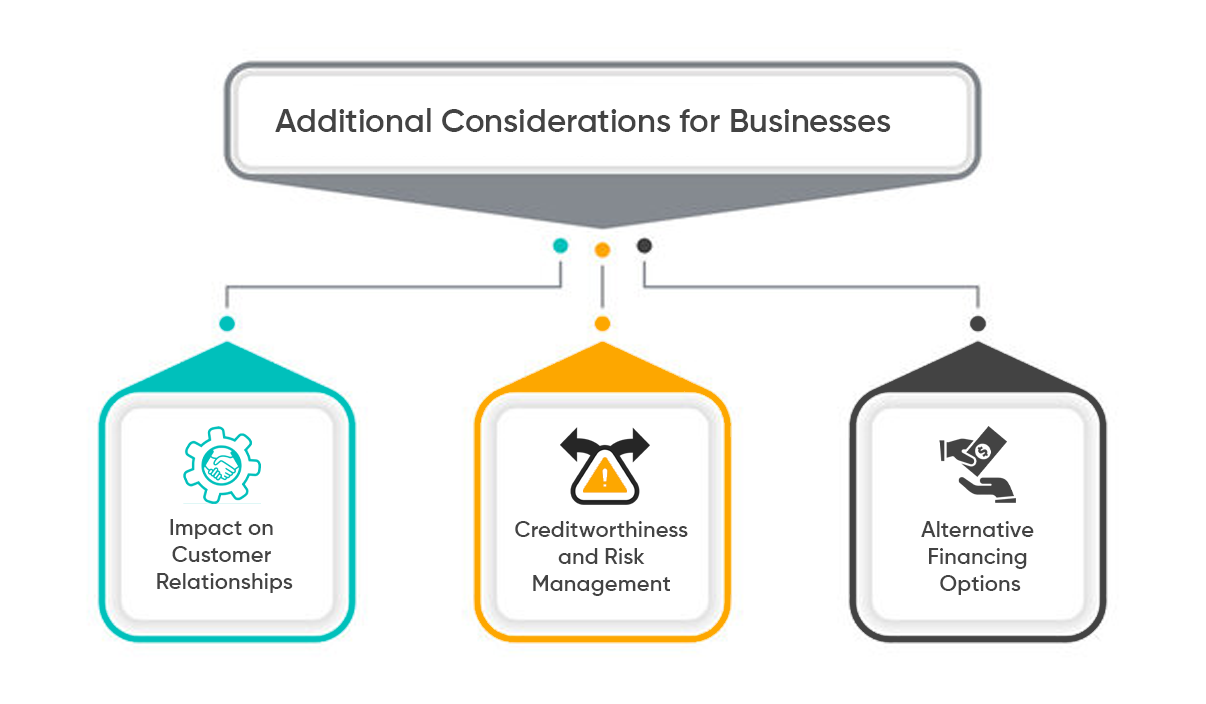

Additional Considerations for Businesses:

- Impact on Customer Relationships: While invoice discounting offers financial benefits, it’s crucial to consider the potential impact on your relationship with customers. Transparency is key. Communicate clearly with your customers about the discounting process, especially if it might affect their payment terms.

- Creditworthiness and Risk Management: Using invoice discounting platforms doesn’t eliminate the risk of bad debts. Utilize the platform’s credit risk assessment tools (if available) or conduct your own due diligence on customers before selling invoices. This helps mitigate the risk of defaults and potential financial losses.

- Alternative Financing Options: Invoice discounting is one tool in your financial toolbox. Consider exploring other options like bank loans, lines of credit, or trade finance, depending on your specific needs and long-term financial goals.

The Future of Invoice Discounting in India

The Indian invoice discounting market is projected to experience significant growth in the coming years. Here are some trends shaping the future of this sector:

- Technological Advancements: Expect continued advancements in automation, artificial intelligence (AI), and data analytics. These technologies can help firms by personalizing loan offers, streamlining the invoice discounting process, and enhancing risk assessment.

- Increased Fintech Participation: Fintech companies are expected to play an even greater role in invoice discounting, offering innovative solutions, wider investor networks, and potentially lower costs for businesses.

- Regulatory Developments: As the market evolves, regulations might adapt to further enhance transparency, security, and accessibility of invoice discounting platforms for businesses of all sizes.

Conclusion

Online invoice discounting platforms offer a valuable tool for businesses of all sizes in India. They can open doors to expansion, enhance working capital management, and enable quicker access to cash flow. Businesses now have more options than ever before because to the increasing number of platforms that are offering competitive rates and features. You can choose the platform that best suits your business and aids in the achievement of your financial objectives by carefully evaluating your demands and comparing your options.

The future of invoice discounting in India looks promising. As technology evolves and regulations adapt, we can expect even wider adoption and greater accessibility for businesses across the country.