Picture this: a thriving Indian business, let’s call it “Desi Designs,” fails to properly track and value its inventory of exquisite handcrafted products. The results could be disastrous, resulting in overspending, false financial reporting, and eventually a decline in profitability. Appropriate inventory valuation is essential for sustaining profitability and making educated decisions in today’s cut-throat business environment. This is where inventory costing techniques are useful since they offer a methodical way to figure out how much ending inventory is worth and how much the cost of products sold is.

For companies in India, regardless of size or sector, it is essential to comprehend the nuances of inventory costing techniques. These techniques have an immediate effect on the financial records, tax liabilities, and general profitability of a business. Businesses can efficiently manage their resources, obtain a competitive advantage, and guarantee compliance with accounting requirements by becoming experts in inventory valuation.

Read Also: What are some of the most popular techniques for Inventory Management?

Understanding Inventory Costing Methods:

Inventory costing methods are techniques used to assign costs to inventory items and determine the value of goods sold during a specific period. These techniques are essential for computing the Cost of Goods Sold (COGS), a significant item on an organization’s income statement. The four main inventory costing methods are:

First-In, First-Out (FIFO):

The FIFO method assumes that the oldest inventory items are sold first, and the remaining inventory consists of the most recent purchases. Under this method, the cost of the oldest items is used to calculate COGS, while the ending inventory is valued at the most recent purchase prices.

Last-In, First-Out (LIFO):

The LIFO method operates on the opposite principle of FIFO. It assumes that the most recently purchased inventory items are sold first, and the remaining inventory consists of the oldest items. COGS is calculated using the cost of the newest purchases, while the ending inventory is valued at the oldest purchase prices.

Weighted Average Cost (WAC):

The WAC method calculates the average cost of all available inventory items during a period. This average cost is then used to determine both the COGS and the value of the ending inventory. The weighted average considers the quantity and cost of each purchase during the period.

Specific Identification:

The specific identification method is typically used for high-value or unique items, where the actual cost of each item can be tracked individually. COGS is calculated by identifying the specific items sold and their respective costs, while the remaining inventory is valued at the specific cost of the remaining items.

Read More: Retail Inventory Management: A Comprehensive Guide for Retailers

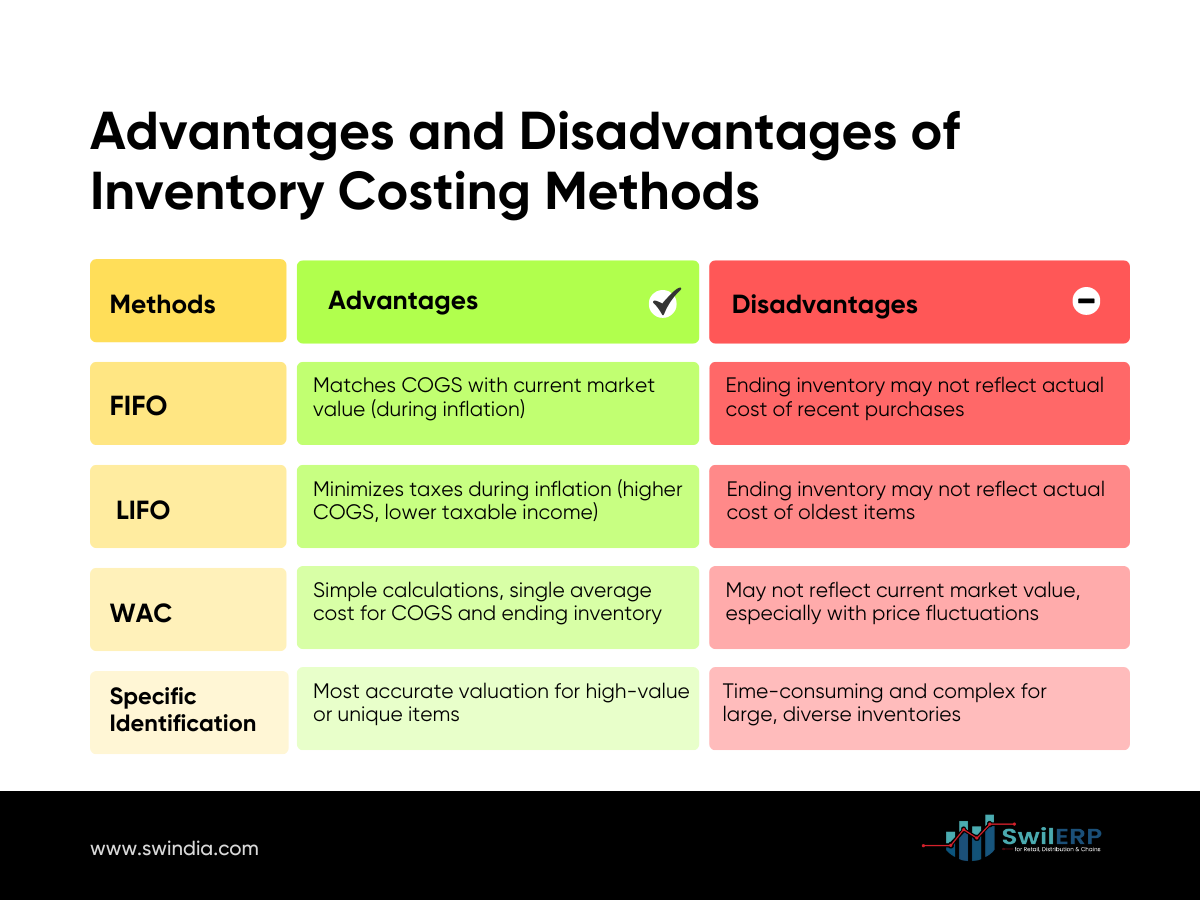

Advantages & Disadvantages of Inventory Costing Methods

1. FIFO:

Advantages: The FIFO method closely matches COGS with current market value, which is particularly beneficial during periods of inflation. It provides a more realistic representation of the current cost of goods sold.

Disadvantages: The ending inventory may not accurately reflect the actual cost of the most recent purchases, which can lead to discrepancies in valuation.

2. LIFO:

Advantages: During inflationary periods, the LIFO method can help minimize taxes by reporting higher COGS and lower taxable income. It can also lead to a smoother income statement, as the impact of cost fluctuations is spread over time.

Disadvantages: Similar to FIFO, the ending inventory may not accurately reflect the actual cost of the oldest items on hand. Additionally, LIFO is not permitted for financial reporting purposes in some countries, including India.

3. WAC:

Advantages: The WAC method simplifies calculations by using a single average cost for both COGS and ending inventory. It provides a consistent COGS across periods, which can be beneficial for businesses with relatively stable inventory costs.

Disadvantages: The WAC method may not accurately reflect the current market value of inventory, especially in periods of significant price changes.

4. Specific Identification:

Advantages: This method provides the most accurate valuation for high-value or unique items, as it tracks the actual cost of each item.

Disadvantages: The specific identification method can be time-consuming and complex, making it impractical for businesses with large and diverse inventories.

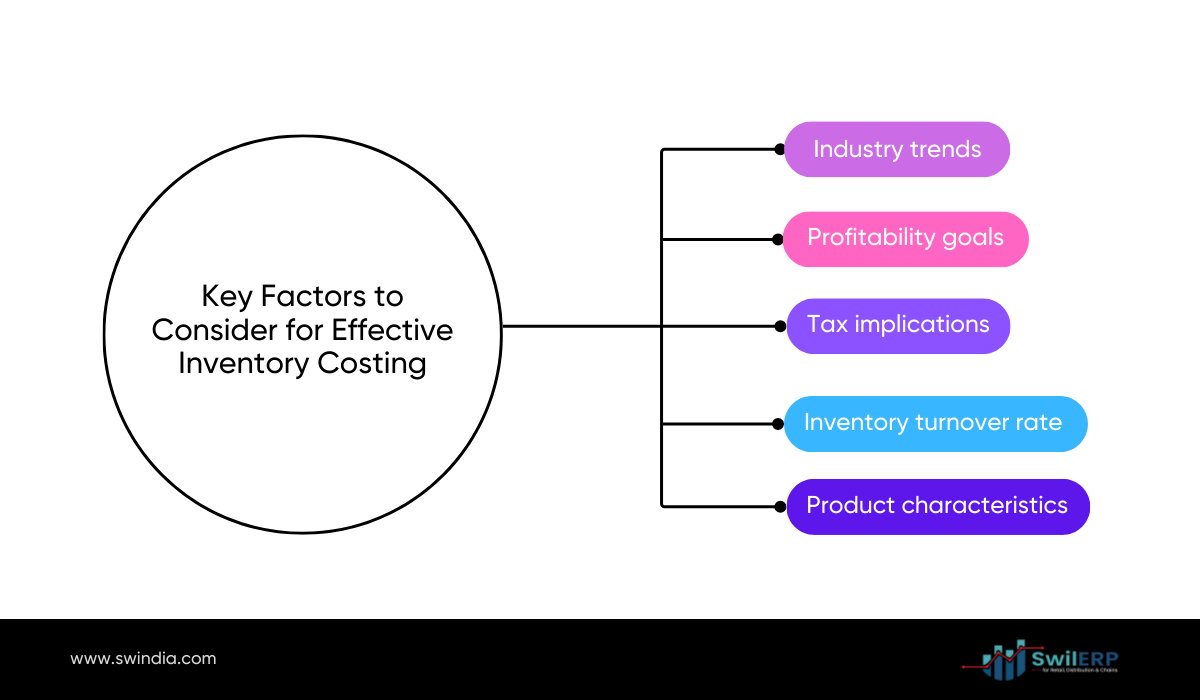

Key Factors to Consider for Effective Inventory Costing

The selection of an appropriate inventory costing method is a strategic decision that should be based on various factors specific to a business. Here are some key considerations:

- Industry trends: Businesses operating in industries with high inflation may benefit from using the FIFO method, as it closely aligns COGS with current market values. Conversely, the LIFO method can be advantageous in industries with deflation or stable prices.

- Profitability goals: If a business aims to maximize reported profits during periods of inflation, the FIFO method may be preferable as it results in lower COGS and higher gross profit. However, if minimizing taxable income is a priority, the LIFO method could be more suitable.

- Tax implications: The LIFO method can provide tax benefits by reporting higher COGS and lower taxable income during inflationary periods. However, it is essential to consider the tax regulations and accounting standards in India.

- Inventory turnover rate: Businesses with high inventory turnover rates and relatively stable costs may find the WAC method more suitable, as it provides a consistent COGS across periods and simplifies calculations.

- Product characteristics: For businesses dealing with high-value or unique items, the specific identification method may be the most accurate approach, despite its complexity.

It is crucial to carefully evaluate these factors and consult with accounting professionals to ensure compliance with applicable regulations and standards in India.

Read Also : E-commerce Inventory Management: A Complete Guide for Online Retailers

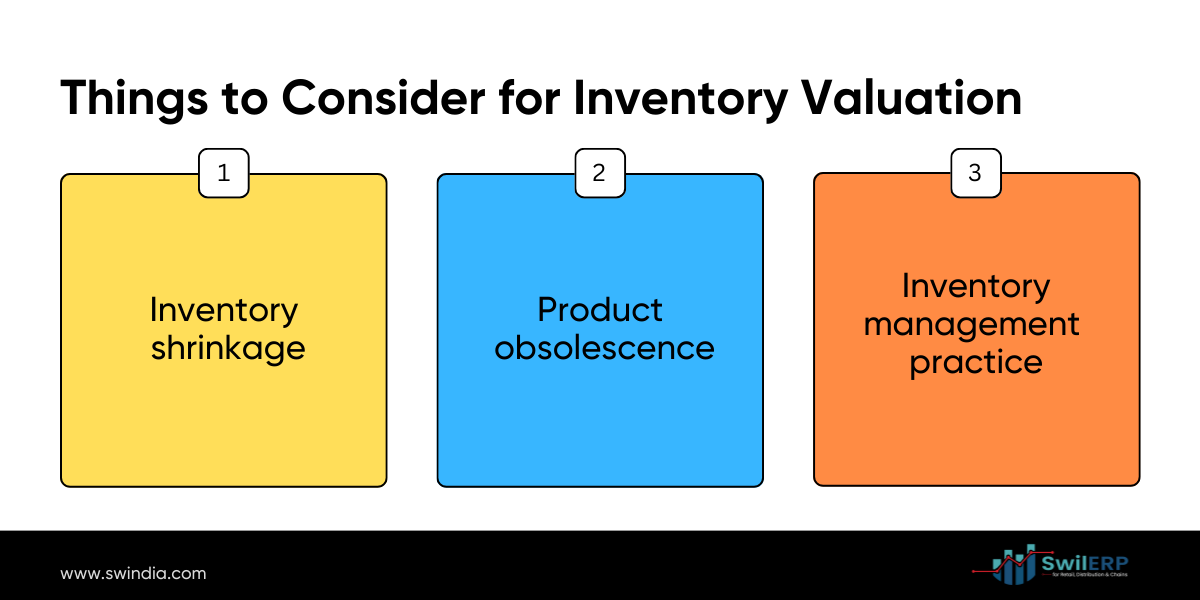

Things to Consider for Inventory Valuation

While inventory costing methods play a significant role in valuation, there are other factors that businesses should consider to ensure accurate inventory valuation:

- Inventory shrinkage: Loss or theft of inventory can impact the accuracy of cost calculations. Companies should put in place the right policies and processes to reduce and account for inventory shrinkage.

- Product obsolescence: Inventory items that become outdated may need to be written off or valued at a lower cost to reflect their diminished value.

- Inventory management practices: Accurate inventory valuation relies on efficient tracking and record-keeping. Carrying out inventory management systems and methodology can assist with guaranteeing the reliability of valuation calculations.

For Instance:

Let’s consider a hypothetical example of an Indian retail business, “Desi Designs,” that specializes in handcrafted sarees and accessories.

Suppose Desi Designs purchases the following quantities of a popular silk saree at different times during the year:

– January 1st: 100 units at ₹5,000 each

– April 1st: 200 units at ₹6,000 each

– July 1st: 200 units at ₹7,000 each

During the year, the store sold 300 units of this silk saree.

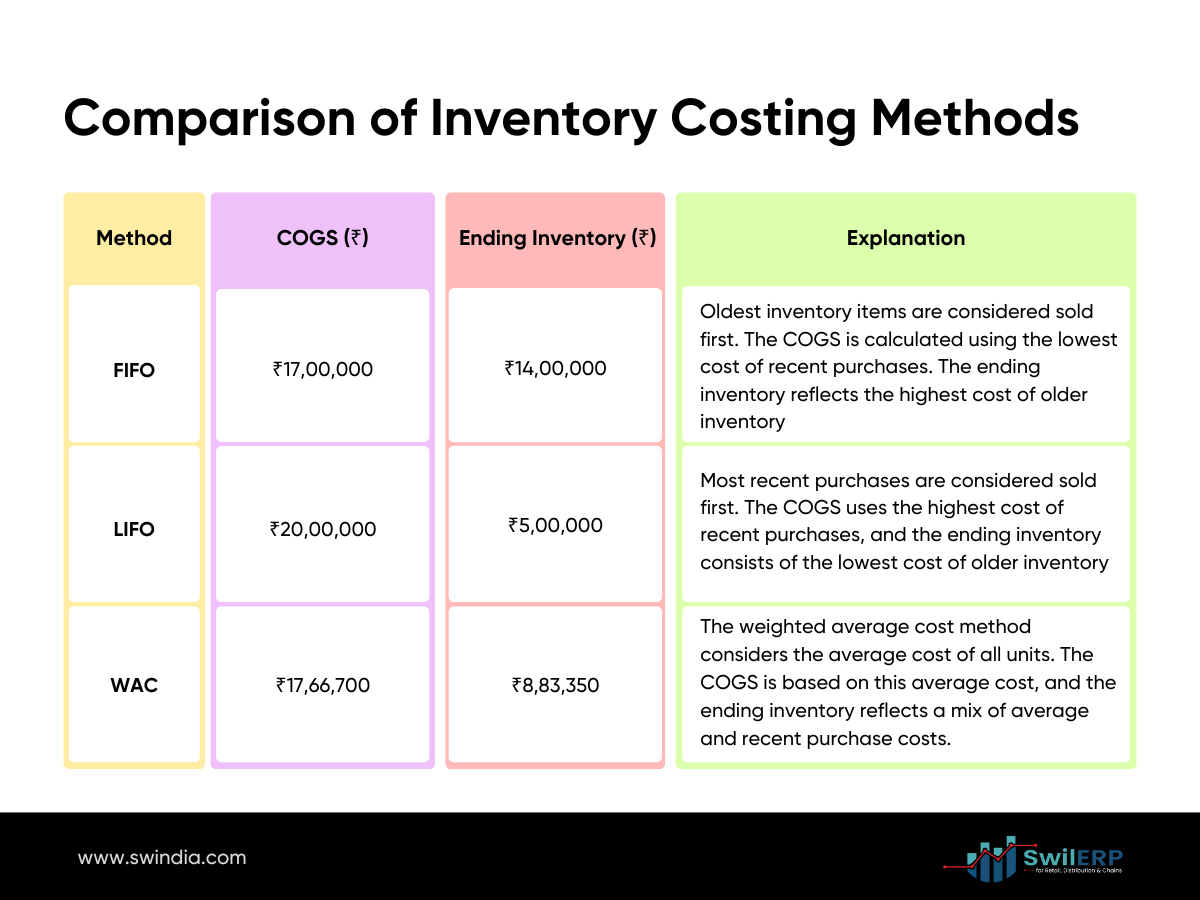

1. FIFO Method:

Under the FIFO method, the oldest inventory items (100 units from January 1st and 200 units from April 1st) would be considered sold first. The COGS would be calculated as follows:

– 100 units at ₹5,000 each = ₹5,00,000

– 200 units at ₹6,000 each = ₹12,00,000

COGS = ₹5,00,000 + ₹12,00,000 = ₹17,00,000

The ending inventory would consist of the most recent purchase (200 units at ₹7,000 each), valued at ₹14,00,000.

2. LIFO Method:

Using the LIFO method, the most recent purchases (200 units from July 1st and 100 units from April 1st) would be considered sold first. The COGS would be calculated as follows:

– 200 units at ₹7,000 each = ₹14,00,000

– 100 units at ₹6,000 each = ₹6,00,000

COGS = ₹14,00,000 + ₹6,00,000 = ₹20,00,000

The ending inventory would consist of the oldest items (100 units from January 1st), valued at ₹5,00,000.

3. WAC Method:

To calculate the weighted average cost, we need to consider the total cost and quantity of all purchases:

– Total cost = (100 × ₹5,000) + (150 × ₹6,000) + (200 × ₹7,000) = ₹26,50,000

– Total quantity = 100 + 150 + 200 = 450 units

Weighted average cost = ₹26,50,000 / 450 = ₹5,889 per unit

The COGS would be calculated as follows:

– 300 units sold × ₹5,889 per unit = ₹17,66,700

The ending inventory would consist of the remaining 150 units, valued at ₹8,83,350 (150 × ₹5,889).

This example demonstrates how the choice of inventory costing method can impact the reported COGS and the valuation of ending inventory, potentially affecting a business’s profitability and financial reporting in India.

To better understand the differences between the inventory costing methods, let’s illustrate them using a visual representation:

By incorporating visuals, readers can easily grasp the varying outcomes of each method and make informed decisions based on their specific business requirements.

Conclusion

A business’s profitability, tax responsibilities, and financial reporting in India can all be greatly impacted by selecting the right inventory costing technique. Businesses can ensure that their actions are in line with their strategic objectives by thoroughly analyzing several elements, including industry trends, profitability targets, tax consequences, and inventory turnover rates, and by grasping the subtleties of each approach.

As you navigate the complexities of inventory valuation, remember that proper implementation and adherence to the chosen costing method are essential for maintaining accuracy and consistency. Tracking, computing, and reporting inventory numbers can also be made much easier by using inventory management software.

If you have specific questions or need further guidance on selecting the best inventory costing method for your business in India, feel free to reach out to our team of experts.

Glossary of Key Terms:

- Cost of Goods Sold (COGS): The direct costs associated with producing or acquiring the goods that a business sells.

- Ending Inventory: The remaining inventory items at the end of an accounting period.

- First-In, First-Out (FIFO): An inventory costing method that assumes the oldest inventory items are sold first.

- Last-In, First-Out (LIFO): An inventory costing method that assumes the most recently purchased inventory items are sold first.

- Weighted Average Cost (WAC): An inventory costing method that calculates the average cost of all available inventory items during a period.

- Specific Identification: An inventory costing method that tracks the actual cost of each individual item, typically used for high-value or unique items.

- Inventory Shrinkage: The loss or theft of inventory items, which can impact the accuracy of inventory valuation.

- Product Obsolescence: The state of inventory items becoming outdated or no longer usable, potentially requiring a write-off or lower valuation.