Now, the goods trade is not limited to the city, state, or country. Trade is now enforced globally, and it must be necessary that goods be accepted globally. For this, many codes have been used in the past to identify the item correctly. And the business owner used to have very high taxes based on usage.

After implementing indirect taxation “GST”, a new HSN code has been introduced to systematically classify goods worldwide and ease GST return filling. HSN stands for Harmonized System of Nomenclature, which primarily aims to make GST systematic and globally accepted.

Article Content-

- Let’s have a real-time scenario to understand HSN and its usage

- Essential Factors of HSN code

- HSN in India

- Wrapping Up

Let’s have a real-time scenario to understand HSN and its usage

These days all businesses file GST, and the products being sold by them fall under the GST category. Thus, if a business wants to get its products recognized at the global level, then using HSN codes is the only solution. HSN Code makes filing your GST easy and globally recognized.

This removes the hassle of repeatedly uploading the details of the product sold. Once you have mentioned the HSN code of the product you are selling (which includes the complete details), you do not need to enter the details again and again for it. Also, it saves you time and automates the filing of GST returns.

This way, it is –

- Helpful to identify the tax rate applicable to a specific product/goods

- Eases imports and exports and gives an analysis

- Helps to determine the quantity of all goods imported or traded through any country

Essential Factors of HSN code

The World Customs Organization (WCO) developed the HSN code and came into effect in 1988. It is-

- A 6-digit uniform code

- Based on the taxpayer’s turnover

- Classifies 5000+ products

- Accepted worldwide

- Arranged in a legal and logical structure

- Uniform classification

- Facilitates international trade

HSN in India

- India has been a member of the World Customs Organization(WCO) since 1971.

- Initially, India used 6-digit HSN codes to classify commodities, but it also created and managed 4 or 8 types of HSN codes for Customs and Central Excise.

- Later Customs and Central Excise added two more digits to make the codes more precise, resulting in an 8-digit classification.

How to avoid mistakes with HSN in GST?

Using software that enhances GST capability with an in-built HSN code feature is an intelligent way to prevent mistakes with your HSN information when filing a GST. With each transaction, you may automatically create GST-compliant invoices without making a mistake in the HSN code.

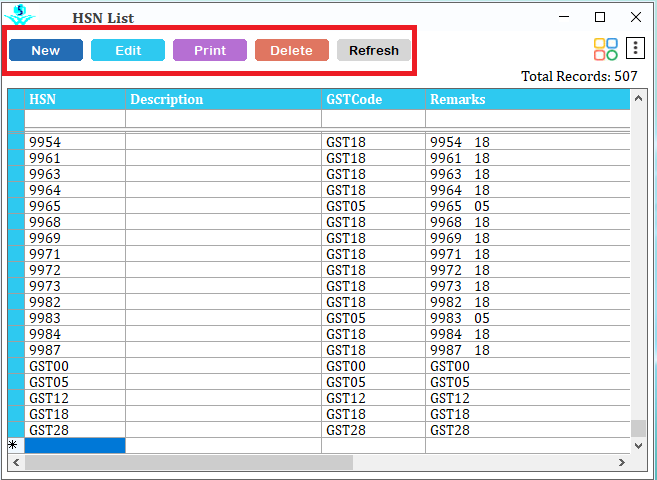

If you are running a pharmacy business, the SwilERP software helps you in creating, updating, and handling of HSN codes. Here, you can handle HSN codes with easy HSN code creation option, Edit Option, HSN code View option, Print option, and Export to Excel option.

To add New, Edit, Print, Delete, and View, you can have following window in the SwilERP.

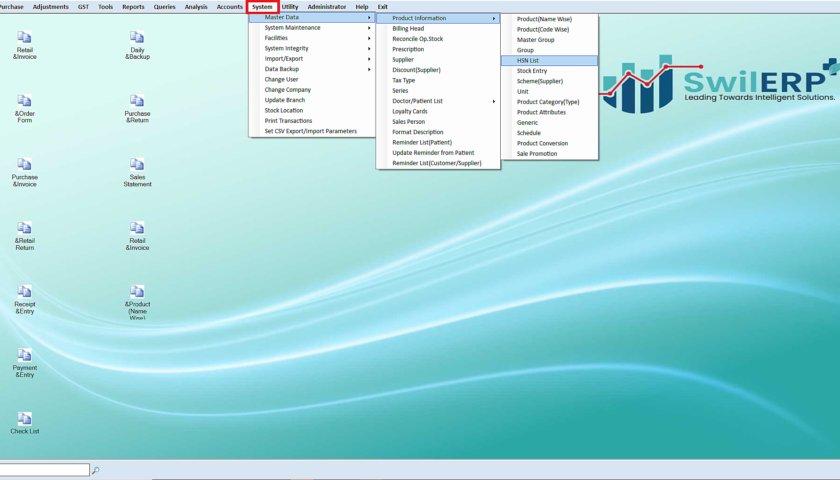

Go to System -> Master Data -> Product Information -> HSN List

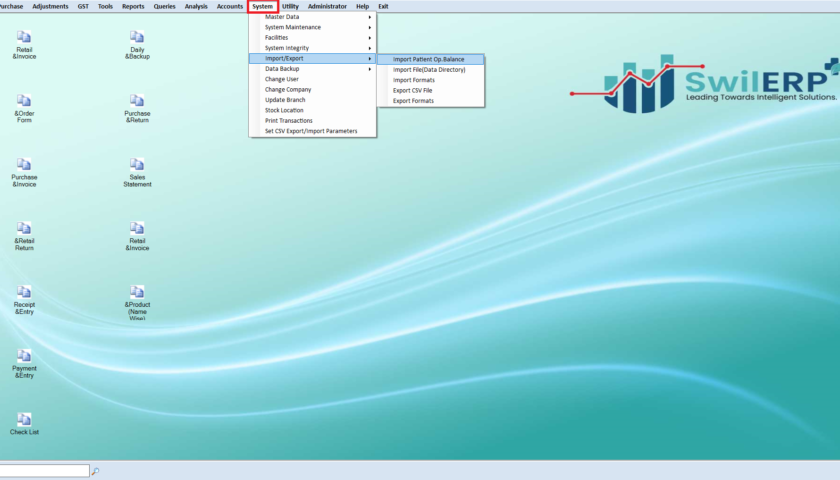

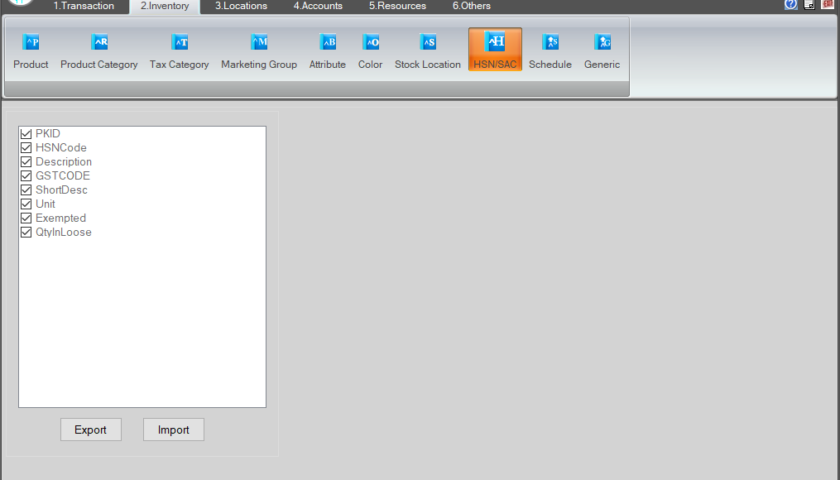

To Import/ Export HSN, go to System -> Inport/ Export -> Import Patient Op. Balance.

Thus, SwilERP provides an easy way to generate and handle HSN codes in your pharmacy business. It gives you easy identification anywhere in the world and eliminates the need to fill in product details over and over again.

Wrapping Up

If you also want the facility related to the HSN code, contact the SWIL team today and avail free demo. For more detail you can read the article Create HSN Code and View HSN List and How to Import & Export HSN.