Introduction

Cash flow, the lifeblood of any business, refers to the movement of money in and out.A sound income guarantees a business can meet its monetary commitments, cover functional expenses, and put resources into learning experiences. Be that as it may, keeping a smooth income can be testing, particularly for organizations with extensive installment cycles.

What is Invoice Financing?

Invoice financing, also known as accounts receivable financing, allows businesses to sell their unpaid invoices to a financing company in exchange for immediate cash. This bridges the much-needed cash flow gap that frequently occurs between sending out invoices and getting paid by customers, which can take weeks or even months.

There are two main types of invoice financing:

Factoring: The financing company assumes ownership of the invoice and handles the collection process.

Discounting: The business retains ownership of the invoice but receives a percentage of its value upfront, minus a financing fee.

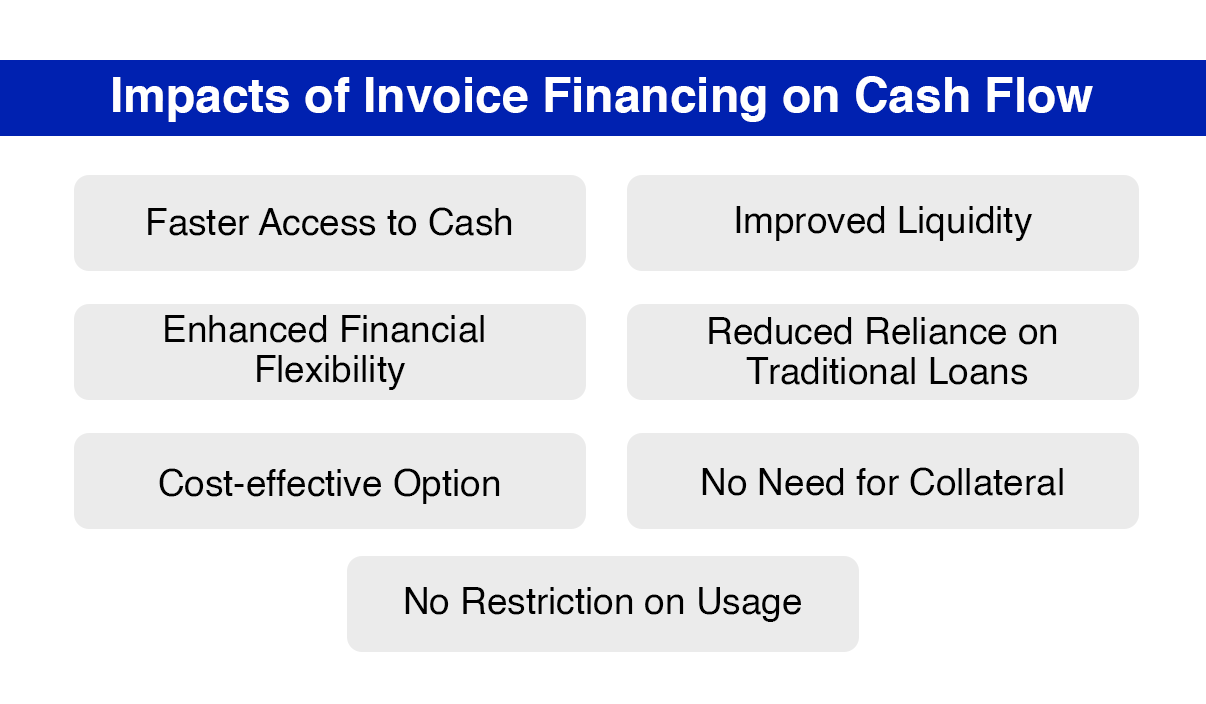

Positive Impacts of Invoice Financing on Cash Flow

Invoice financing offers several advantages for businesses struggling with cash flow:

1. Faster Access to Cash: Instead of waiting for customers to settle their invoices, businesses receive immediate funding, allowing them to cover expenses, payroll, and other obligations without delay.

2. Improved Liquidity: The influx of cash enhances a business’s overall liquidity, making it easier to meet short-term financial needs and avoid potential disruptions.

3. Enhanced Financial Flexibility: With improved cash flow, businesses gain greater freedom to invest in growth initiatives, purchase inventory, or explore new market opportunities.

4. Reduced Reliance on Traditional Loans: Invoice financing can be an alternative to securing traditional loans, which often involve complex application processes and stringent eligibility criteria.

5. Cost-effective Option: Compared to traditional loans, invoice financing fees can be more competitive, especially for businesses with a good track record.

6. No Need for Collateral: Unlike loans that require businesses to pledge assets as security, most invoice financing arrangements use the invoice itself as collateral. This makes it accessible for even small businesses with limited assets.

7. No Restriction on Usage: Unlike some loan types, funds obtained through invoice discounting can be used for any business purpose, allowing for greater flexibility in financial planning.

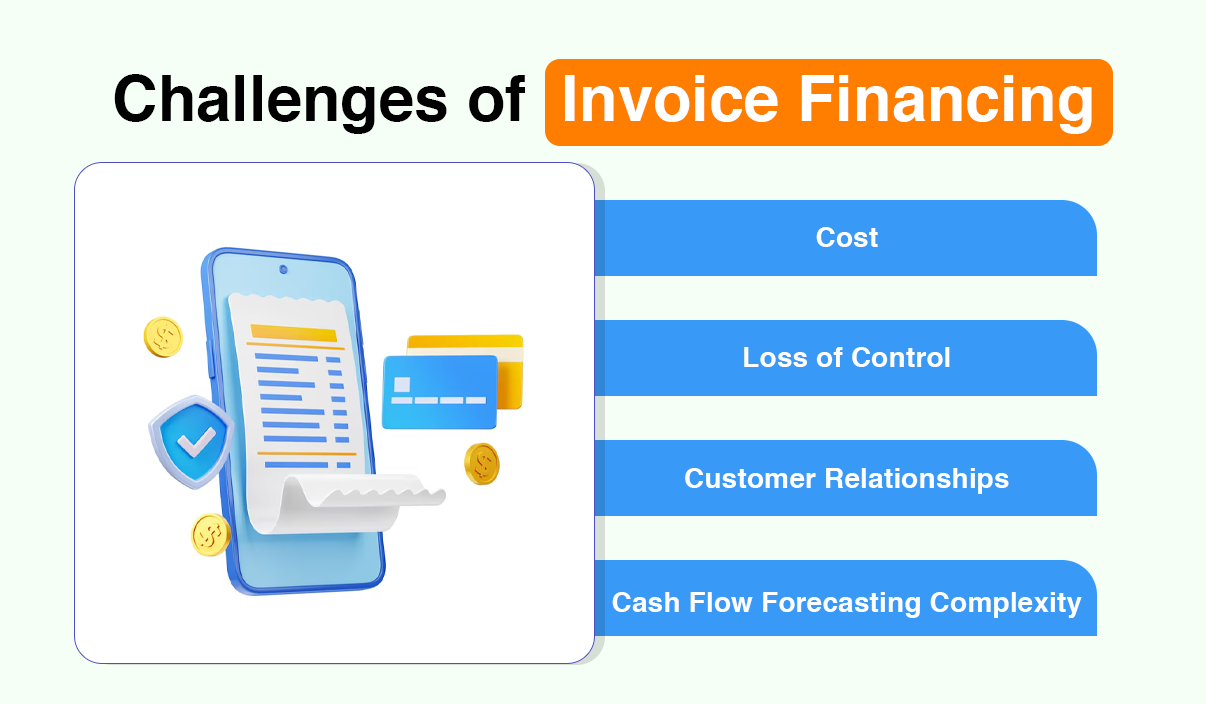

Potential Challenges of Invoice Financing

While invoice financing offers numerous benefits, it’s crucial to consider potential drawbacks:

1. Cost: Invoice financing fees can be higher than traditional loan interest rates, impacting profit margins.

2. Loss of Control: Businesses may relinquish some control over the collection process, as the financing company might handle communications and negotiations with customers.

3. Customer Relationships: Depending on the financing type, customers might be notified about the arrangement, potentially impacting relationships and trust.

4. Cash Flow Forecasting Complexity: Accurately forecasting cash flow can become more intricate due to outstanding financing arrangements and potential variations in fees and payment timelines.

How Does Invoice Financing Impact Cash Flow?

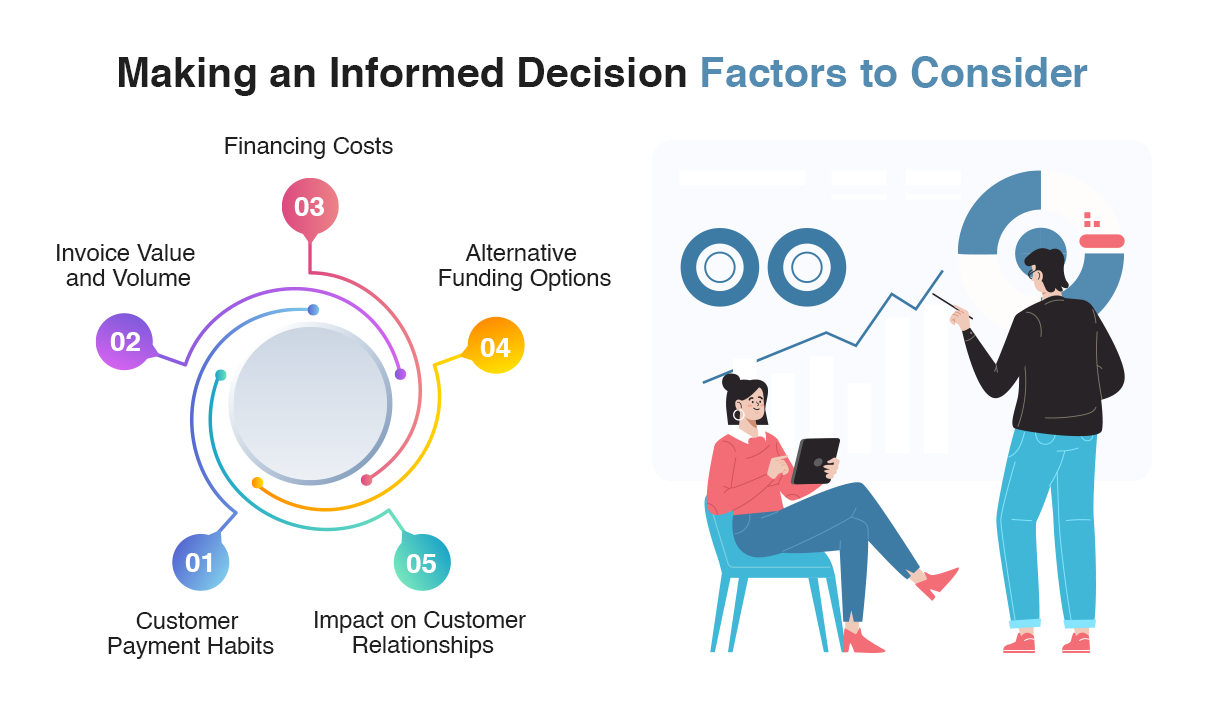

Making an Informed Decision: Factors to Consider

While invoice financing presents a tempting solution for immediate cash flow needs, it’s not a one-size-fits-all approach. Several crucial factors deserve careful consideration before making a decision:

● Customer Payment Habits: Analyze your customer base and their payment history. Invoice financing is most effective when dealing with customers with a good track record of paying their invoices eventually, albeit slowly.

● Invoice Value and Volume: The value and volume of your invoices directly impact the feasibility and cost-effectiveness of invoice financing. Consider the total amount you need to finance and the frequency of generating invoices to ensure the arrangement is financially viable.

● Financing Costs: Compare fees and interest rates offered by different financing companies.Comprehend the construction of these expenses, including start expenses, markdown rates, and any continuous support charges. Negotiating competitive prices is critical for minimizing the impact on your profits.

● Alternative Funding Options: Explore other potential sources of funding, such as traditional loans, lines of credit, or merchant cash advances. It is possible to make an informed choice by weighing the benefits and drawbacks of each option in relation to invoice finance.

● Impact on Customer Relationships: Depending on the chosen financing type, your customers might be notified about the arrangement.

Seeking Professional Guidance

Navigating the complexities of financial decisions, especially those related to cash flow management, can be challenging. Consulting with a qualified financial professional is highly recommended. They can:

➤ Analyze your financial situation: Provide an in-depth analysis of your current cash flow, identify any underlying issues, and assess your overall financial health.

➤ Negotiate terms: Assist with negotiating competitive rates and terms with financing companies, ensuring you receive the most favorable deal possible.

➤ Develop a long-term strategy: Partner with you to develop a long-term financial strategy that addresses your cash flow challenges and promotes sustainable business growth.

Beyond Invoice Financing: Managing Cash Flow Holistically

While invoice financing can provide temporary relief, it’s crucial to remember that it’s not a long-term solution for managing cash flow. Here are some additional strategies to consider:

➤ Negotiate shorter payment terms: Negotiate shorter payment terms with your customers to expedite invoice collection and reduce waiting times.

➤ Offer early payment discounts: Incentivize prompt payments by offering discounts to customers who settle their invoices within a specific timeframe.

➤ Improve invoicing efficiency: Streamline your invoicing process by automating tasks and ensuring timely and accurate invoice issuance.

➤ Monitor receivables closely: Keep track of outstanding invoices and proactively follow up with customers approaching their payment due dates.

➤ Reduce operating expenses: Analyze your operational costs and identify areas for potential cost reduction without compromising quality or service.

By combining these methods with prudent financial management practices, you can build the groundwork for healthy and sustainable cash flow, assuring your company’s long-term success.

Invoice finance offers an important technique for overseeing brief cash flow issues, enabling fast access to funds and further developing liquidity. In any case, it’s crucial to approach this choice methodically, taking into account the expected downsides, investigating choices, and looking for proficient direction. Keep in mind, that a comprehensive way to deal with overseeing cash flow management, enveloping different methodologies and practices, is critical to accomplishing financial stability and driving your business towards reasonable development. By carefully navigating the financial landscape and settling on informed choices, you can guarantee your business flourishes, liberated from the restraints of slow-paying clients and unusual cash flow changes.

Conclusion

Invoice financing undeniably impacts a business’s cash flow landscape. Carefully evaluating your specific needs and consulting with a financial professional can help determine if invoice financing is the right fit for your business and its unique cash flow challenges.

Invoice financing offers a valuable tool for managing temporary cash flow challenges, providing immediate access to funds and improving liquidity. However, it’s essential to approach this decision strategically, considering the potential drawbacks, exploring alternative options, and seeking professional guidance. Remember, a holistic approach to managing cash flow, encompassing various strategies and practices, is key to achieving long-term financial stability and propelling your business towards sustainable growth. By carefully navigating the financial landscape and making informed decisions, you can ensure your business thrives, free from the constraints of slow-paying customers and unpredictable cash flow fluctuations.