In the quick moving universe of business, where each choice counts, a fine understanding of financial management is fundamental. The “cost sheet” is a tool that is frequently underestimated in its importance at the center of this financial puzzle.

Read Also : Figure out What, Why & How of Accounting & Finance in ERP Environments

What is a Cost Sheet: A Fundamental Explanation

A cost sheet is not just a ledger filled with numbers; it’s a roadmap that outlines the financial journey of a business. It’s a thorough record detailing the different costs a business causes during its tasks. From unrefined components to the above expenses, the expense sheet portrays the financial health of a business more or less.

Read Also : Corporate Accounting: A Complete Guide Including Benefits You Need to Know About it

Importance and Objectives of Cost Sheets

The significance of cost sheets cannot be exaggerated.By surveying the expense of creation, supporting estimating choices, and working with planning processes, cost sheets engage organizations to explore the mind-boggling universe of money with certainty.

Read Also : How to Reduce Accounting Workload with the Accounting Management Software

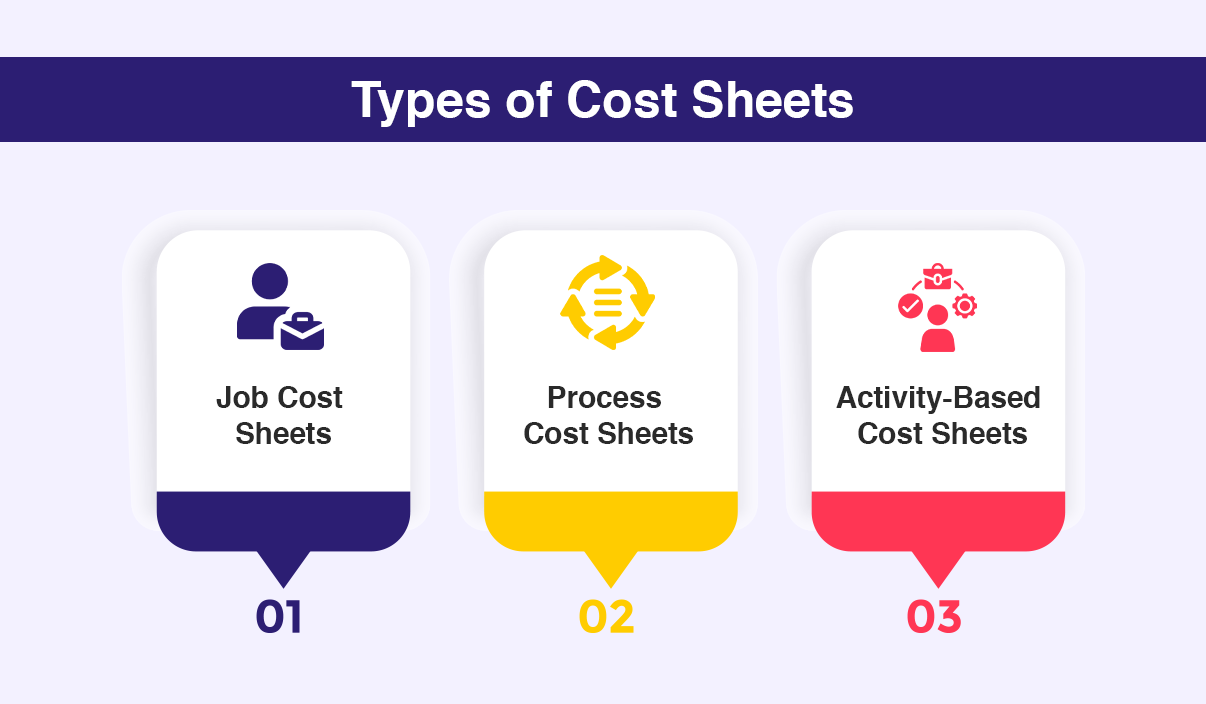

Types of Cost Sheets

Diversity reigns even in the realm of cost sheets. Whether it’s work cost sheets, process cost sheets, or action-based cost sheets, each type assumes an extraordinary part, offering organizations custom fitted experiences into their financial scene.

Job Cost Sheets

Job cost sheets are similar to detailed diaries of specific projects within a business. They exactly record all costs associated with a particular job, from labor to materials. For facilitating better decision-making, this detailed level of insight allows businesses to evaluate the profitability of individual projects.

Process Cost Sheets

In the manufacturing world, where products go through various stages of production, process cost sheets come into play. Offering a complete view, these sheets aggregate costs across multiple production stages, of the entire manufacturing process.

Activity-Based Cost Sheets

In the time of accuracy, activity-based cost sheets arose as significant tools. They distribute expenses for explicit exercises inside the business, giving a definite breakdown of costs connected with each functional capability. This clear examination empowers organizations to share assets proficiently and distinguish regions for possible expense decrease.

Understanding these varied types of cost sheets is like having a diversified financial toolkit.

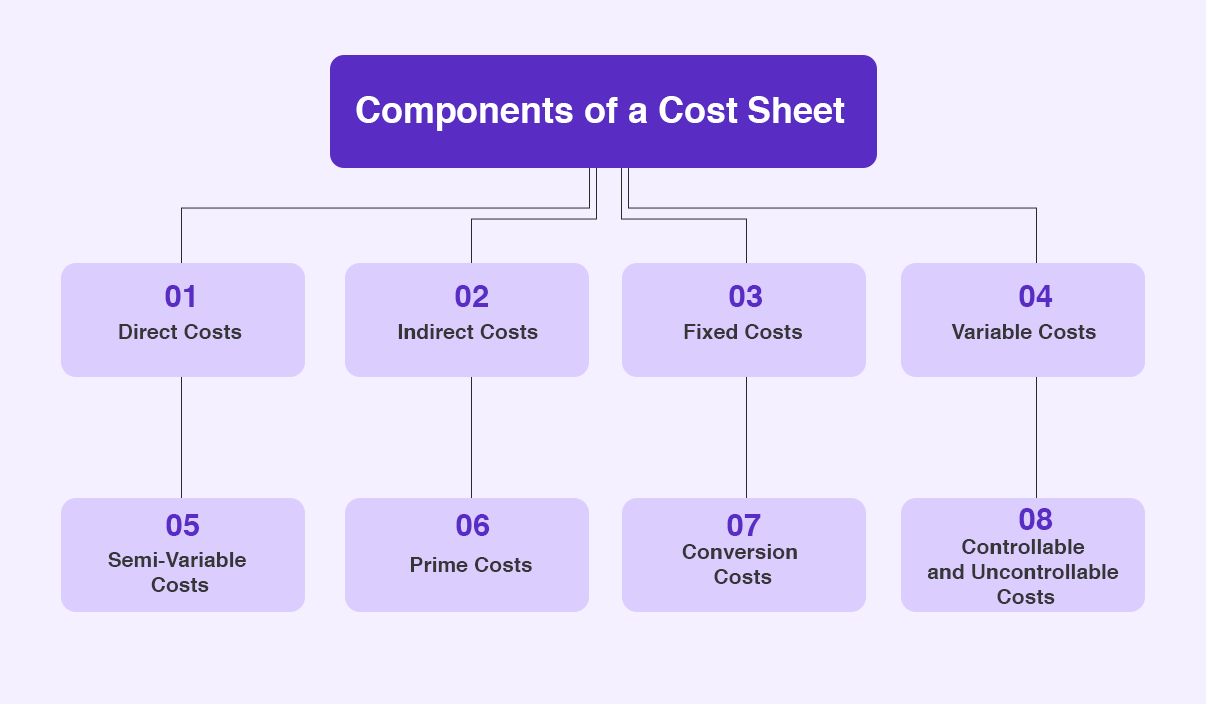

Components of a Cost Sheet

Now, let’s break down the anatomy of a cost sheet. From direct costs to indirect costs, understanding these elements is similar to understanding the language of finance.

1. Direct Costs:

These are the tangible expenses directly associated with the production of goods or services. Direct costs encompass raw materials, labor, and other expenses directly tied to the creation of a product or service.

2. Indirect Costs:

Unlike direct costs, indirect costs are not directly traceable to a specific product or service. Indirect costs such as rent, utilities, and administrative salaries are essential for a complete financial evaluation, as they include overhead expenses.

3. Fixed Costs:

Fixed costs remain constant irrespective of the production output. Understanding fixed costs like rent, salaries of permanent staff, and insurance is crucial for predicting baseline financial commitments, as these encompass expenses.

4. Variable Costs:

Variable costs fluctuate with the level of production or service delivery. Examples include raw materials, direct labor, and utilities directly tied to the volume of output.

5. Semi-Variable Costs:

Semi-variable costs show characteristics of both fixed and variable costs. These expenses may have a fixed component but vary with the level of production or activity.

6. Prime Costs:

Prime costs encompass the direct expenses involved in the production process, including direct materials and direct labor. For gaging the core expenses tied directly to production, understanding prime costs is crucial.

7. Conversion Costs:

Conversion costs involve the expenses incurred in converting raw materials into finished products. This includes direct labor and manufacturing overhead. For evaluating the efficiency of the production process,grasping conversion costs is vital.

8. Controllable and Uncontrollable Costs:

Controllable costs are within the influence of management and can be adjusted or managed. Uncontrollable costs, on the other hand, are beyond immediate management control. For effective cost management strategies, recognizing this distinction is crucial.

Preparing a Cost Sheet: The Process

Preparing a cost sheet involves an organized journey. Each step contributes to the accuracy of the financial analysis, from the thorough collection of data to the final presentation. The journey of preparing a cost sheet requires a careful choreography of steps. Initiating with the thorough collection of data, businesses navigate through cost categorization, allocation, and calculation. Assembling these details results in the final presentation, a comprehensive snapshot of financial realities.

Strategic Uses and Benefits of Cost Sheets

Cost sheets are not static documents; they are dynamic tools with strategic implications.The power of cost sheets lies in their ability to shape sound financial strategies, for effective cost control, and informed pricing decisions. Businesses can utilize cost sheets in the budgeting process as a cornerstone.

Challenges and Limitations in Cost Sheet Preparation

As with any tool, cost sheets come with their own set of challenges. Acknowledging these hurdles is the first step towards overcoming them. Businesses improve not only the precision of their financial analyses but also their capacity for making decisions by overcoming obstacles during the preparation phase. It looks like providing your

monetary procedure with a solid arrangement of instruments to explore difficulties and settle on additional educated decisions.

Conclusion

Taking everything into account, embracing the force of cost sheets isn’t a choice; Any company that wants to grow and be financially stable must have it. This blog has spread out the layers of the expense sheet, underlining its significance, parts, and vital applications.