Introduction

In the business world, maintaining a steady cash flow is vital for growth. However, irregular payment schedules and late-paying customers can often disrupt this crucial aspect. This is where invoice factoring emerges as a valuable tool, providing companies with a necessary solution to manage their income and gain quick financial flexibility. This guide delves into the intricacies of invoice factoring, equipping you with the knowledge to understand its advantages, eligibility requirements, and the process involved.

What is Bill Discounting?

Bill discounting, also known as invoice discounting, is a financial mechanism that allows businesses to convert their unpaid invoices into immediate cash.

- Bills of Exchange: These are formal documents that represent a promise to pay a specific amount at a future date.

- Beneficiary: The party entitled to receive payment, typically the seller of goods or services.

- Discount Rate: The percentage charged by the financial institution for converting the invoice into immediate cash.

Essentially, a business sells its unpaid invoices to a financial institution (bank, factoring company) at a discounted price. This discount is the institution’s cost for providing quick funds and taking on the risk of not getting paid by the client.

There are two primary options for bill discounting:

Recourse Bill Discounting: In this scenario, the business remains liable if the customer fails to pay the invoice. The financial institution can then seek repayment from the business.

Non-Recourse Bill Discounting: This option offers business protection against bad debt. However, it typically comes with a higher discount rate, reflecting the increased risk assumed by the financial institution.

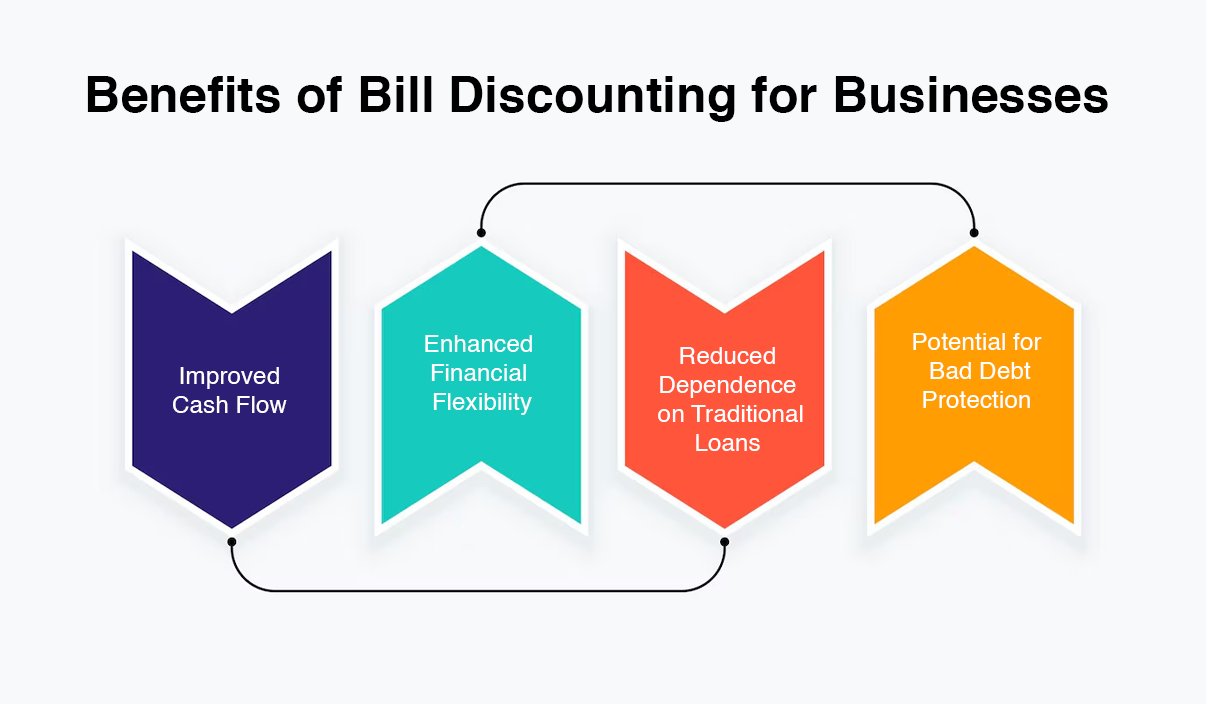

Benefits of Bill Discounting for Businesses

Bill discounting offers several advantages for businesses struggling with cash flow challenges:

1. Improved Cash Flow: By transforming unpaid invoices into immediate cash, businesses can meet pressing financial obligations, cover operational costs, and maintain smooth day-to-day operations.

2. Enhanced Financial Flexibility: The unlocked funds can be utilized for diverse purposes, such as investing in growth opportunities, managing inventory fluctuations, or covering unexpected expenses. Businesses are better equipped to handle unforeseen situations and make strategic decisions because to this flexibility.

3. Reduced Dependence on Traditional Loans: Bill discounting provides an alternative financing option compared to traditional loans.It may be a more accessible option because it frequently entails simpler application processes and faster approval dates.

4. Potential for Bad Debt Protection: In some cases, financial institutions offer bad debt protection, safeguarding businesses against the risk of unpaid invoices in exchange for additional fees.

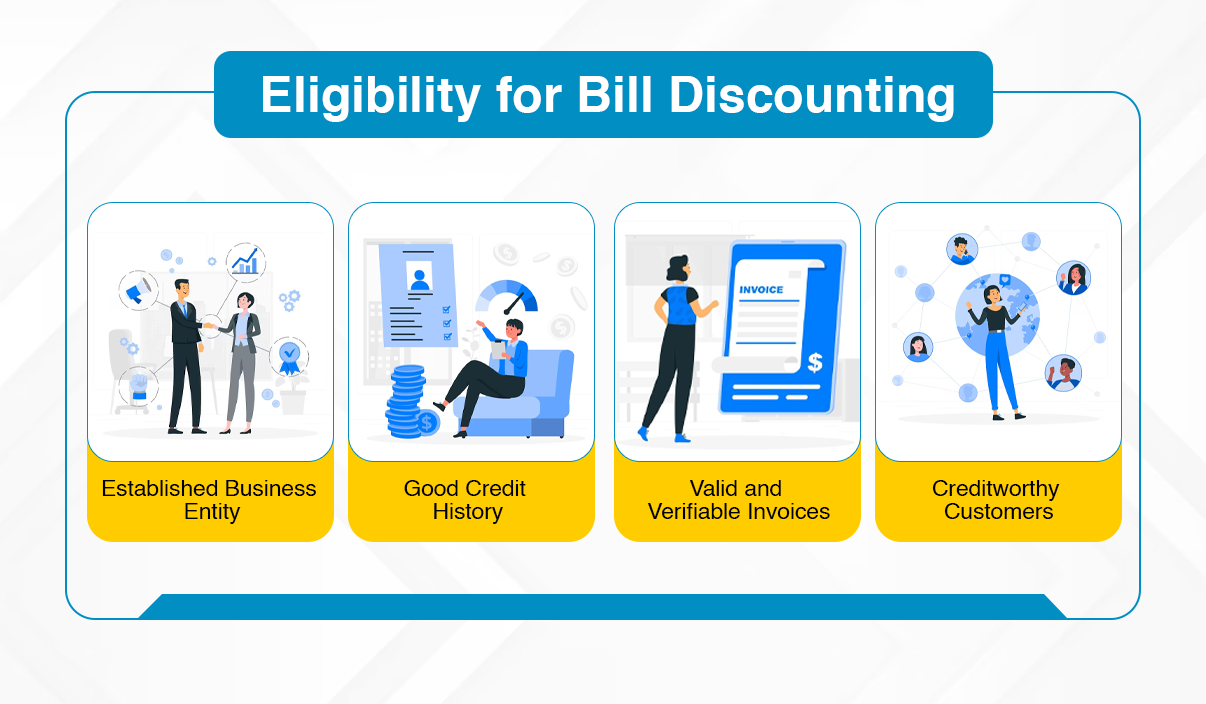

Eligibility for Bill Discounting

While specific requirements may vary slightly between institutions, some general criteria for bill discounting eligibility include:

- Established Business Entity: The business should be a legally registered entity with a demonstrable track record of operation.

- Good Credit History: A positive credit history demonstrates the business’s ability to manage debt responsibly, making it a more attractive candidate for bill discounting.

- Valid and Verifiable Invoices: Businesses must present valid and verifiable invoices with clear payment terms and details of the goods or services provided.

- Creditworthy Customers: Ideally, customers should have a good reputation for making timely payments, minimizing the risk of bad debt for the financial institution.

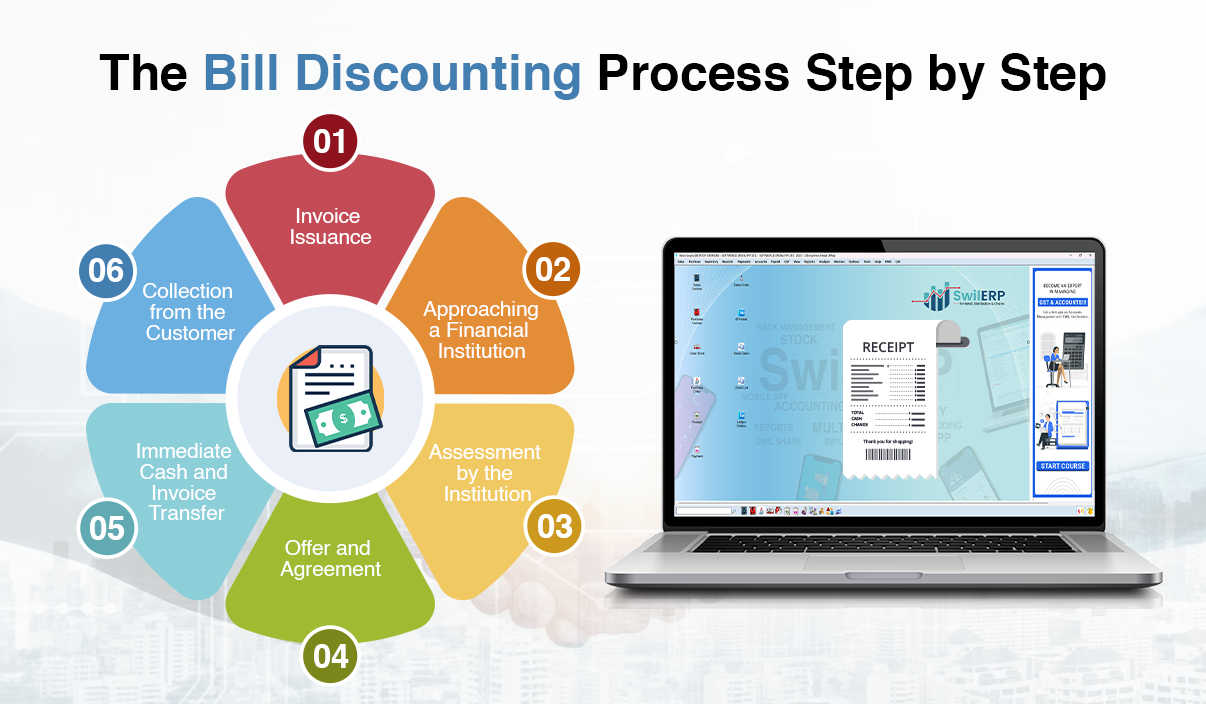

The Bill Discounting Process: Step-by-Step

Understanding the process involved in bill discounting is crucial for businesses considering this option:

1. Invoice Issuance: The business raises an invoice and sends it to the customer for payment, outlining the goods or services provided, the agreed-upon price, and the payment due date.

2. Approaching a Financial Institution: The business approaches a financial institution, such as a bank or a factoring company, and expresses their interest in bill discounting.

3. Assessment by the Institution: The institution carefully evaluates the invoice, the business’s creditworthiness, and the customer’s payment history.

4. Offer and Agreement: Upon approval, the institution offers a discounted amount against the invoice value, essentially purchasing the invoice at a reduced price.

5. Immediate Cash and Invoice Transfer: If the business agrees to the terms, it receives immediate cash from the institution and transfers ownership of the invoice to them.

6. Collection from the Customer: The financial institution then assumes responsibility for collecting payment from the customer at the invoice’s due date.

Costs and Considerations of Bill Discounting

While bill discounting offers undeniable benefits, it’s crucial to be aware of the associated costs and potential challenges:

- Discount Rate: This is the key cost associated with bill discounting. It represents the percentage deducted from the invoice value by the institution in exchange for immediate cash.

- Processing Fees: Some institutions may charge additional processing fees to cover administrative costs associated with handling the transaction.

- Bad Debt Protection Charges: If opting for non-Bad Debt Protection Charges: If opting for non-recourse bill discounting, where the business is protected against bad debt, additional fees are typically charged to compensate the institution for assuming the increased risk.

Potential Challenges and Considerations:

- Loss of Control over Collection Process: Once the invoice is sold, the business relinquishes some control over the collection process.

- Impact on Customer Relationships: Depending on the discounting method, the customer might be notified about the arrangement, potentially impacting the business relationship. It’s fundamental to keep up with openness and interaction with clients to moderate any bad discernment.

- Careful Fee Evaluation and Comparison: It’s crucial to evaluate the discount rates carefully and processing fees charged by different institutions. Looking at offers from different suppliers guarantees you get the most competitive terms and limits the financial effect on your business.

Conclusion

A useful technique for companies looking to close the payment gap between invoices and receipts is bill discounting. It offers potential protection against bad debt, improves financial flexibility, and gives quick access to cash. Before making a decision, it’s crucial to comprehend the related expenses, probable difficulties, and the significance of careful consideration. Before beginning bill discounting, it is important to speak with financial consultants and thoroughly evaluate your unique financial requirements. Recall that this financial instrument may be a useful tool for strategy, but only if it is used carefully and in conjunction with an all-encompassing cash flow management plan.