This union budget 2023-based article highlights the Budget presented by Union Finance Minister Nirmala Sitharaman on Wednesday. It is the fifth Budget of Modi 2.0.

In the last full-fledged Budget, Nirmala Sitharaman said that the Indian economy is on the right path and heading towards a bright future.

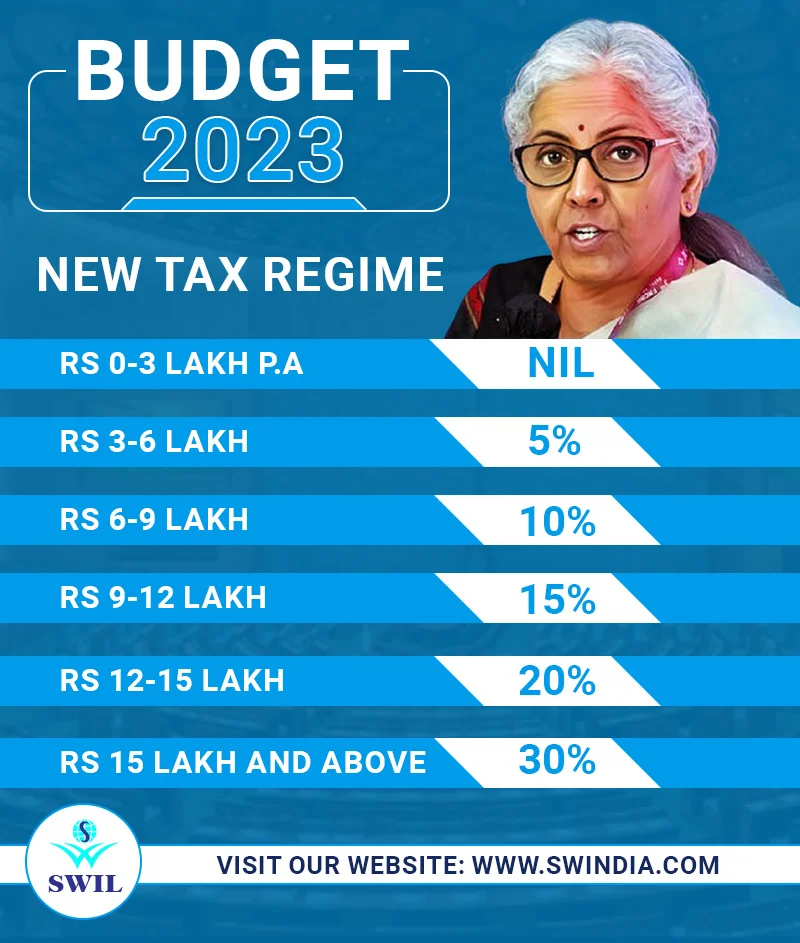

Sitharaman announced significant modifications to the tax slabs under the new tax regime as well as a significant increase in funding for railways and capital expenditures, which will greatly benefit taxpayers and the economy.

Let’s have a quick look at Union Budget 2023 and know what this budget has in store for you.

Amrit Kaal : Vision of Union Budget 2023-24

1. Facilitating a variety of opportunities for citizens, particularly for young people

2. Providing a powerful boost to growth and job creation

3. Establishing macroeconomic stability

Saptarishi : 7 Priorities that Covered in Union Budget 2023

- Inclusive Development

- Reaching the last mile

- Infrastructure and investment

- Unleashing the potential

- Green growth

- Youth power

- Financial sector

Revised Income Tax & Personal Finance

Tax slab rationalization is announced under new regime with new slabs as shown below:

Key highlights of Budget 2023

- Addressing the program, she started with an achievement during the Covid pandemic, in which over 80 crore people were provided free food by the Government of India for 28 months with the primary objective of ensuring that no one sleeps hungry.

- She declared on January 1, 2023, the beginning of the Pradhan Mantri Garib Kalyan Anna Yojana. This scheme will give free food grains to all Antyodaya and priority households for a year.

- She added that India’s recognition as a worldwide shining star with an anticipated growth rate of 7.0% for the current year is a great moment for the country.

- The FM states that the EPFO membership has doubled as an indication of the formalization of the Indian economy.

- She also highlighted the Atmanirbhar Swachh Plant program, which has a budget of Rs 2,200 crore and aims to boost the supply of disease-free, premium planting material for priceless horticulture crops.

- Over the next three years, the government plans to hire 38,800 teachers and support personnel to renovate 740 residential schools modeled after the Eklavya model that serve 3.5 lakh tribal students.

Highlights of the Budget in Various Business Sectors

Infrastructure

It is intended to rejuvenate 50 additional heliports, water aerodromes, landing strips, and airports. A total of INR 75,000 crore will be invested in 100 crucial infrastructure projects for the steel, ports, fertilizer, coal, and food grain industries, including INR 15,000 crore from private investors.

The FM would allocate Rs 19,700 crore to the National Hydrogen Mission to reach a 5 million metric tonne hydrogen production capacity by 2030.

FM Pradhan Mantri Kaushal Vikas Yojana 4.0 was introduced by Nirmala Sitharaman to provide youth with in-demand skills for chances abroad. She also announced the wonderful news about the future establishment of 30 Skill India International Centers in various states.

50 tourist spots will be chosen after a difficult procedure, and they will be transformed into a complete package for both domestic and foreign tourism.

Agriculture

The government will allocate specific money to assist young entrepreneurs in rural areas who are starting agri-tech businesses.

10,000 bio-input resource centers will be constructed over the course of the next three years, and one crore farmers will receive aid in switching to natural agricultural methods.

To encourage innovation and research by startups and universities, a national data governance policy will be introduced. This will make it possible to obtain anonymous data.

As a central repository for financial and related information, the government intends to create a National Financial Information Registry. At 6.4% of GDP, the fiscal deficit has been updated.

Engineering colleges will set up 100 labs for the development of 5G-powered apps.

In order to realize new business models and employment prospects, these labs will investigate the whole range of opportunities in sectors like intelligent transportation systems, healthcare, precision agriculture, and smart classrooms.

According to the Finance Minister, the budget deficit must be brought down to 4.5% of GDP or less by 2025–26.

The government suggested exemptions from customs duty on the import of capital goods and equipment required for lithium-ion batteries.

In order to bring silver’s customs charge into line with gold and platinum, the administration also suggested raising it.

For some brands of cigarettes, an increase in the NCCD of 16% was indicated.

Tax returns are processed more quickly

From 93 days to 16 days, the average processing time for income tax returns has been slashed. “Our taxpayers’ portal got a maximum of 72 lakh returns every day; processed more than 6.5 crore returns this year; average processing length dropped from 93 days in financial year 13–14 to 16 days currently; and 45% of the returns were completed within 24 hours,” said FM Nirmala Sitharaman.

Typical IT Return Forms

To assist taxpayers in resolving problems with income tax payments, the government plans to introduce the most recent common IT Return forms and increase the channels for taxpayers to file complaints.